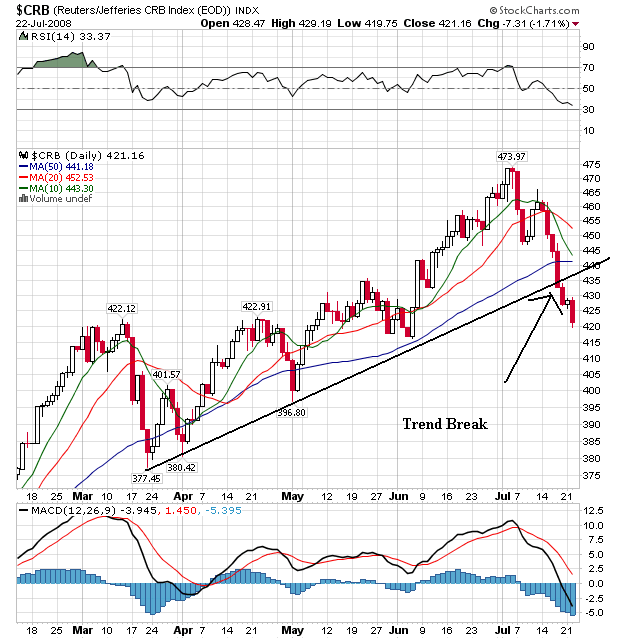

Thanks to the drop in both oil (see tomorrow) and agricultural prices (see below) we see the CRB index has broken a key trend line that started in mid to late March. Also note the following:

-- Prices are below all the SMAs

-- The 10 day SMA has crossed below the 20 day SMA

-- The 10 and 20 day SMA are both headed lower

-- The 10 day SMA is about to cross over the 50 day SMA

This chart is turning short-term bearish.

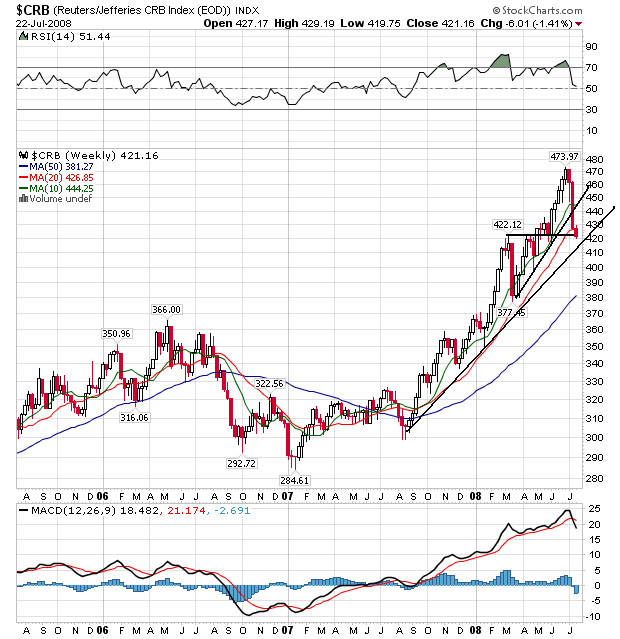

On the weekly CRB chart, notice the longer term uptrend is still in place. However, prices have moved through the 10 and 20 week SMA and are standing at a key support level.

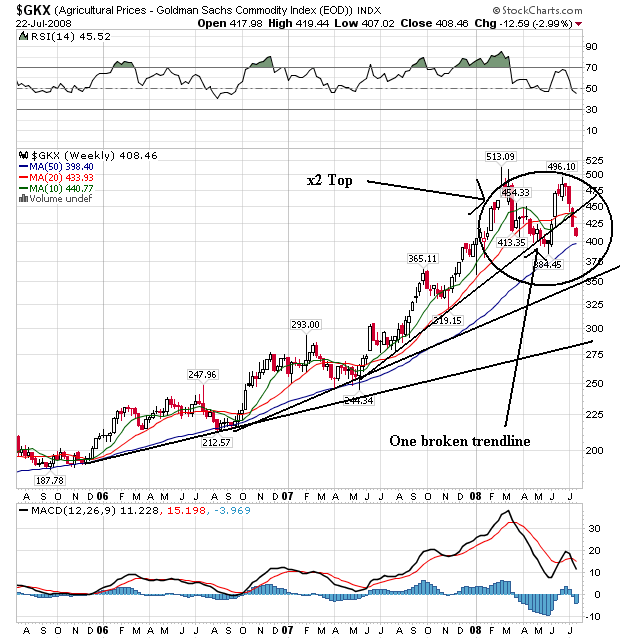

The possibility of a double top is becoming more and more likely with the agricultural prices chart. We won't know for sure until there is a definite trend break below the low point between the two tops. Until that happens, this could be a sideways consolidation as well as a possible double top.

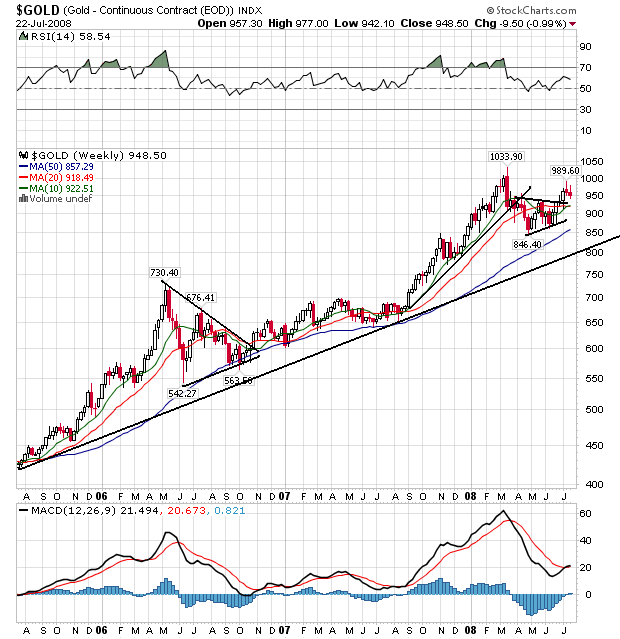

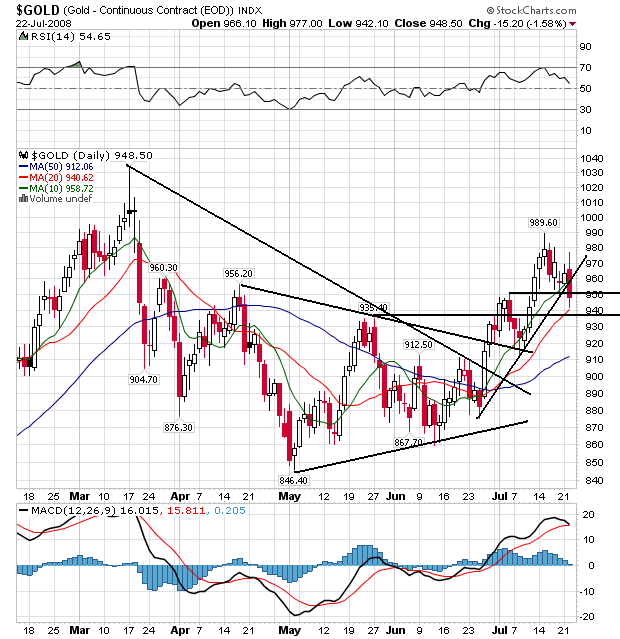

Gold has broken out of a triangle consolidation and is still in a three year uptrend. But, notice recent upward price moves have stalled a bit which is clearer of the daily chart:

Notice the following:

-- Prices have clearly broken out of a triangle consolidation and are heading higher.

-- The shorter SMAs are above the longer SMAs

-- All the SMAs are moving higher

-- Prices are using the 10 say SMA as technical support

However, combine the daily and the weekly gold charts and you'll notice on the weekly chart the last few weeks have printed some smaller candles. These could be simple pullbacks as traders book gains and wait for the next bit of news that will send prices higher. However, the recent price drops in both agricultural and oil prices may be giving gold traders reason to pause a bit and consider their next moves.

Let's tie all of these charts together.

-- Gold tells us that traders are possibly thinking commodity price pressure is slowing a bit

-- Agricultural prices may be forming a double top

-- The CRB index is clearly dropping as well

All of this bodes well for overall price pressures if these trends continue.

No comments:

Post a Comment