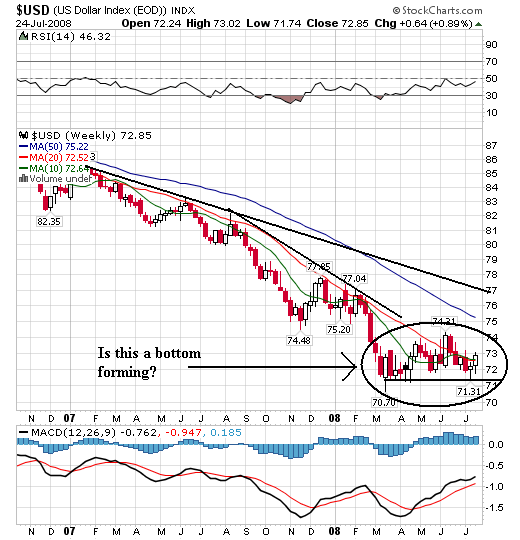

Notice the dollar has been in a clear downtrend for the last 6 years. That is a very long-lasting bear market.

On the weekly chart, notice the following:

-- Prices dropped for all of 2007. However,

-- We've seen prices stabilize around the 71-74 level. They have been at these levels for the last four months which is enough time to speculate about a bottom forming. This is a very important development. Why might prices be stabilizing? Here are a few thoughts.

1.) Bear markets only last so long. This one has lasted for the last 6 years. Think of this as the theory of inevitability.

2.) There has been a fair amount of talk about inflation from various Treasury and Federal Reserve officials. Now -- the US has had a "strong dollar" policy for the last 7 years so these statements have to be taken with a grain of salt (or an entire shaker).

3.) The markets might be thinking that given current economic facts and variables this is an appropriate price level for the dollar. After all, it has fallen quite a bit over the last 7 years.

These are all just theories.

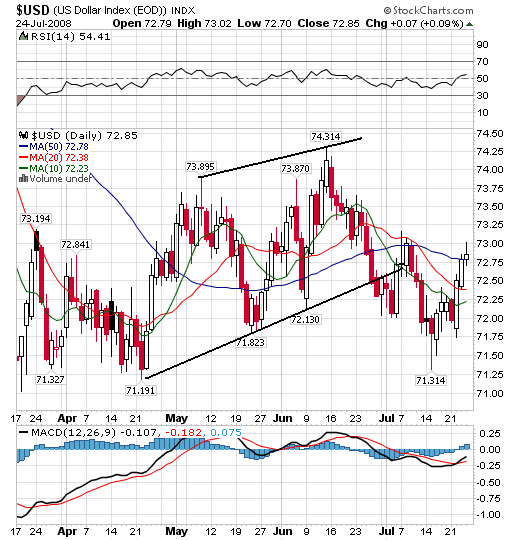

On the daily chart, notice the following:

-- There is an overall price range from 71.25 to 74 over the last few months.

-- Prices were in a slightly upwardly sloping channel from the end of April to the end of June, but they have since pulled back.

-- The SMAs aren't giving a firm reading in either direction right now. They are all heading lower but they recently they were all heading higher.

No comments:

Post a Comment