Policy makers in emerging economies from Russia to Vietnam may have to start acting less like Ben S. Bernanke and more like Paul Volcker if they want to bring inflation under control.

With currencies tied to the U.S. dollar, officials in many developing countries have had to keep their monetary policies linked to the Federal Reserve's. Now, after chairman Bernanke led the Fed's most aggressive easing in two decades, their central banks find themselves with interest rates too low for their economies and the worst bout of inflation in a generation.

``There's a lack of independent monetary policy; it's been inappropriately stimulative,'' says Nariman Behravesh, chief economist with Global Insight in Lexington, Massachusetts. The answer, he says, may be to ``tighten credit more aggressively,'' the way then-chairman Volcker did in the early 1980s.

Such a policy shift would mean pushing borrowing costs above the level of inflation and keeping them there even at the cost of a steep slowdown that might send commodity prices into a tailspin. Faced with inflation that approached 15 percent in 1980, Volcker pushed interest rates as high as 20 percent and drove the U.S. into its deepest recession since the 1930s.

Prices are now surging across the developing world. China's inflation rate stayed near a 12-year high of 8.7 percent in May; prices in Vietnam jumped 27 percent in June and Indian wholesale prices increased 11.6 percent last month, the fastest in 13 years. Inflation exceeds benchmark lending rates in China, Russia, India and at least a dozen other emerging economies

Paul Volcker is my favorite Federal Reserve Chairman. He was faced with the most difficult policy decision a central banker can face -- high inflation and a slowing economy. Volcker chose to raise interest rates to kill inflation. He was directly responsible for the double dip recession of the early 1980s which really hurt. But on the other side of that policy decision was low inflation which makes life a great deal easier.

Volcker realized a very important point: as a central banker sometimes you have to sacrifice popularity in order to do the right thing. By the time Volcker took office the inflation genie was already out of the bottle and the only way to contain it was to spike interest rates hard.

Right now all central banks are facing a similar situation -- declining growth and spiking commodity prices. The US attempted to dodge this bullet by arguing only core CPI mattered in their interest rate decisions. Other central banks weren't so brazen in their attempts to dodge the problem. However they are still facing similar problems.

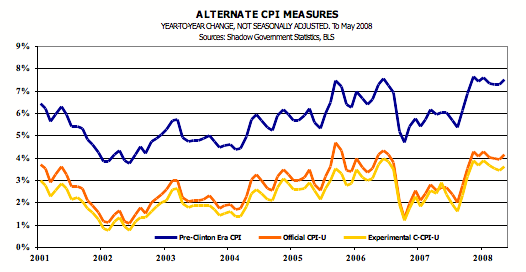

In addition, the US is dealing with a problem of self-deception. Here is a chart from the website Shadow Stats that shows how the US has changed the way it computes CPI.

If we justs change the way we compute CPI all will be well. Unfortunately, the market is not buying it.

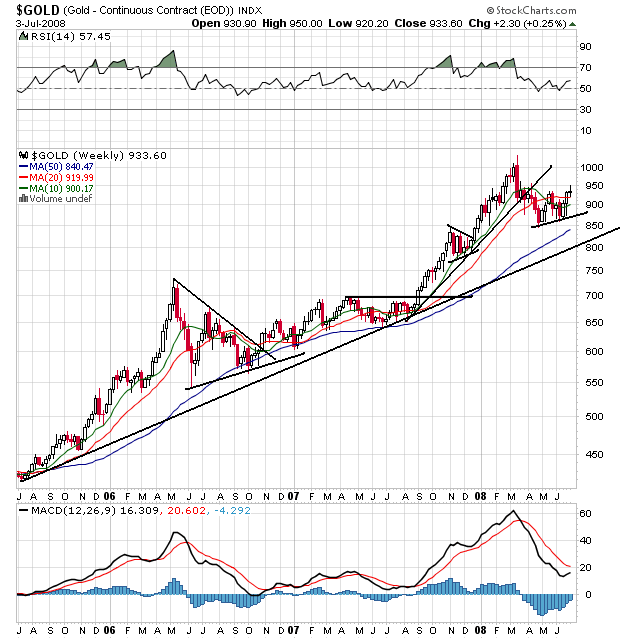

Notice that gold has nearly doubled in the last 3 years. Assuming that gold is a proxy for inflation expectations (which it is) this chart indicates traders are really worried about inflation.

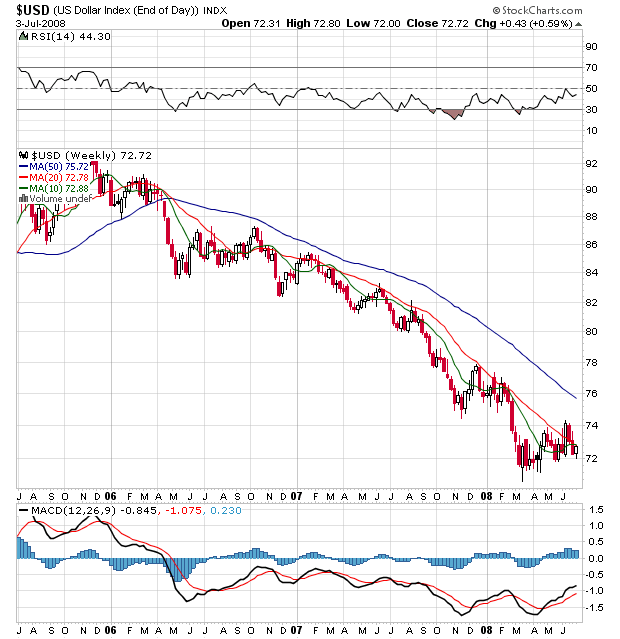

Also note the massive drop in the dollar's value since 2006:

This didn't happen by accident. Traders are looking at the US economy and it's underlying fundamentals and voting with their trades to get the hell out.

There are no easy ways to deal with the current situation. Commodity prices are spiking because of increased demand. These spiking prices are doing two things -- they are creating a wave of supply push inflation which in turn is raising prices. This is leading to a slowing economy as manufacturers pass these cost increases onto consumers in various forms. For example, DuPont just announced a 25% increase in prices because rising manufacturing costs. FedEx and UPS have also announced several price increases as have all the airlines. And don't get me started about gas prices.

Whoever wins the election and whoever assumes Fed leadership after Bernanke will have to find their inner Volcker. And fast.

No comments:

Post a Comment