The Treasury market is abuzz with chatter about possible changes to the government's supply calendar as the bill for the credit crunch and the weak economy keeps rising.

The Treasury Department reports its next quarterly refunding schedule on July 31. Bond investors are speculating it could bring back either the three-year note, which was eliminated a year ago, or the seven-year note, which was last sold in 1993, to meet its increased funding needs. A third option is to expand the sale of 10-year notes, making it a monthly event. Currently, the department auctions a new 10-year note every quarter and reopens it one month later.

The need for change in the supply calendar has grown in the past year as the economy has slowed, resulting in lower tax receipts. This year's economic-stimulus package has added to the budget shortfall. Other items, such as support for mortgage lenders Fannie Mae and Freddie Mac, would further increase borrowing needs.

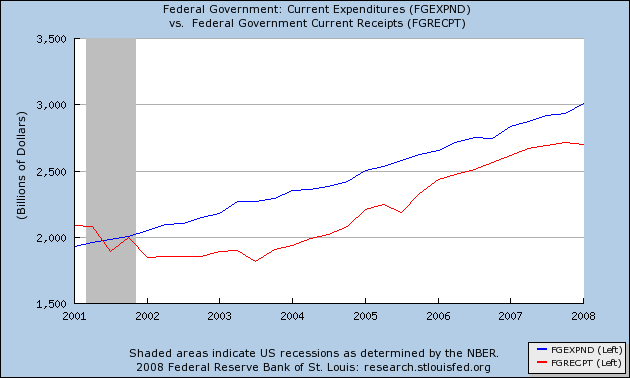

Let's take a look at the government's revenue and expenditure line from the St. Louis Federal Reserve:

Notice that space between the red and blue line? That has to be filled in by debt. And here is the debt we have issued over the last 7 years:

09/30/2007 $9,007,653,372,262.48

09/30/2006 $8,506,973,899,215.23

09/30/2005 $7,932,709,661,723.50

09/30/2004 $7,379,052,696,330.32

09/30/2003 $6,783,231,062,743.62

09/30/2002 $6,228,235,965,597.16

09/30/2001 $5,807,463,412,200.06

09/30/2000 $5,674,178,209,886.86

Given the top chart, it's no wonder that we need more debt. But note that the government has needed debt for some time. This isn't a new development.

No comments:

Post a Comment