From the WSJ:

Projections suggest the federal budget deficit could exceed $500 billion next year, complicating the debate between Barack Obama and John McCain over how to strengthen the economy while not worsening the nation's finances.

Deficit projections are ballooning because of lower tax receipts and government spending on economic-stimulus programs. The gap increasingly is threatening to play havoc with the two presidential candidates' domestic-policy plans, particularly Sen. McCain's big tax cuts and Sen. Obama's promised health-care expansion, and could force major changes in the winner's agenda.

On Monday, Sen. McCain, the Republican candidate, sought to turn the new deficit numbers to his short-term political advantage, without conceding much to those longer-term realities. Democratic rival Sen. Obama sought to keep the focus on the current shaky economy, economic inequalities and worries over job and retirement security.

The sparring came as the White House budget office boosted its estimate of the federal deficit for fiscal 2009 to $482 billion. With the full costs of the wars in Iraq and Afghanistan added in, the deficit for 2009 likely would exceed $500 billion, analysts said. The deficit projection for 2008 fell somewhat from the last official estimate in February, to $389 billion from $410 billion. Fiscal 2008 ends Sept. 30.

Expect to hear more of these stories come out as the economy worsens.

I wrote an article a few weeks back called My Conversation With the Next President. In the article I highlighted the basic problem the next president faces. Here is the short version. The Bush administration has mis-managed the federal budget situation to an alarming degree. Although they inherited a budget surplus, they have continually spent more then they have taken in. As a result, the US is issuing debt like its going out of style. Total debt outstanding has increased from $5.8 trillion in 2001 to the current total of $9.5 trillion.

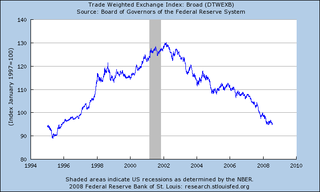

As a result of this problem, the currency markets have sent the dollar lower for six years straight.

If you were wondering why commodities in general and oil specifically have bee rallying for some time, you can thank the cheap dollar as a primary cause. While a stronger dollar alone would not solve the problem of expensive oil, it would definitely help. Consider the dollar chart above. Note it has gone from peak to trough from 130 to its current level of $72.75 -- or a drop of 44%. Also note that most world commodities (like oil) are priced in dollars. As the dollar has dropped in price, so have these commodities. One of the primary reason traders are bidding them up is as an inflation hedge. While that appears to have waned for now, the damage has already been done in the form of higher prices being passed on to the consumer.

And that's not all. The US has been issuing a ton of debt every year during the good economic years. This means that going into the bad years we have a ton of more debt on our books and a culture of not making the tough political decisions (like, for example, raising taxes on the upper-income levels to help pay for a war). As a result, the US is entering a period of economic hardship with both hands tied behind its back.

Theoretically, a government should help to mitigate the effects of a recession with increased spending on programs like unemployment insurance extensions, job retraining, tax credits to start new economic sectors and the like. This goes a whole lot better if the government managed the budget well during the times of growth. However, the US has not done that. Instead, we have loaded up the federal government with a large amount of debt which has helped to devalue our currency which is increasing inflation. Issuing more debt will add further downward pressure on the dollar adding to the current inflationary pressures. In short, doing what the government should do during this time is exactly what the government has been doing for some time and it has led to problems.

It's not a pretty picture, is it?

No comments:

Post a Comment