Central banks must act firmly to avoid risks to price stability from rising inflation, European Central Bank Governing Council member Miguel Angel Fernandez Ordonez said on Wednesday.

Ordonez saw risks soaring raw material costs would lead to a spiral in consumer prices and wage demands that would further feed inflation. "Economic authorities, in particular monetary ones, have the duty to avoid these risks, to prevent these threats to price stability materializing, and as a result they must - we must - act with firmness," Ordonez, also governor of the Bank of Spain, said during an economic seminar in Madrid.

Let's compare this idea with the US method for dealing with inflation.

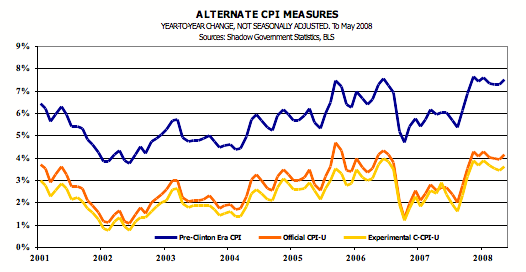

First, the US changes the way it computes CPI in order to make it look lower:

See -- inflation is lower! We can now lower interest rates.

Then instead of looking at all prices, we only look at those prices that are low, thereby making it easier to lower rates. This is the "core inflation canard" that was instigated by Greenspan. It's a wonderful way to deal with inflation -- if you don't consume food or energy. For those of us who like to eat three squares a day and leave the house occasionally, it is a terrible way to measure inflation.

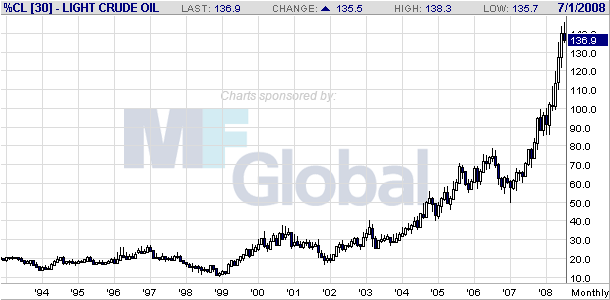

Here's what's great about the "core canard". This chart doesn't matter:

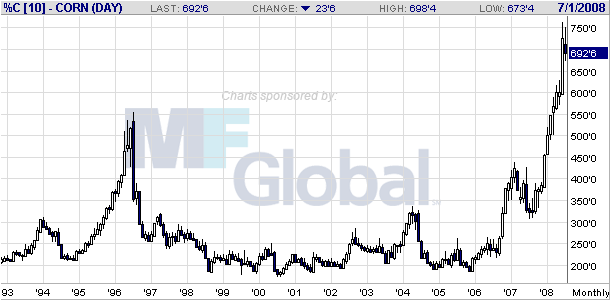

And neither does this one:

Thanks to the magic of ignoring important facts we can set interest policy where we want! YEAH!

Until the US realizes that its fundamental central bank methodology is fundamentally flawed we'll continue to experience the problems we currently have -- asset inflation caused by recklessly low interest rates.

No comments:

Post a Comment