This alone should have raised some eyebrows and sounded the alarms. But this wasn't all. At the same time, the US was invading Iraq adding to middle eastern turmoil, China and India were growing at strong clips (Russia wasn't that far behind) and there was talk everywhere of the global commodities boom. By this time Toyota had introduced the Prius which has now sold over 1 million cars indicating there is a strong demand for energy efficient vehicles. Yet Detroit continued giving us the Hummer and various other forms of inefficient vehicles. Bottom line, Detroit is full of idiots who deserve to fail. And fail one of them will.

Consider this news about Chrysler over the last few days:

From Reuters:

Fitch Ratings downgraded Chrysler LLC's debt further into the junk category and warned that the struggling U.S. automaker could face difficulties in financing unless U.S. auto sales recovered in 2009.

Chrysler, which lost $1.6 billion in 2007, could struggle to finance operations in the second half of 2009 if industry volumes remained at this year's depressed levels or dropped further, according to a Fitch report released on Tuesday.

Fitch, which cut Chrysler's ratings from B- to CCC, just two notches above default, said the decision last week by Chrysler's finance arm Chrysler Financial to stop financing vehicle leases for U.S. consumers would depress already sluggish sales.

It rated Chrysler's outlook as negative, indicating a further rating cut is likely in the next six months.

Considering how easy it is to buy good credit ratings from the ratings agencies (CDO, anyone?), the fact that Fitch has downgraded debt to these levels should tell you how bad things have gotten.

From the WSJ:

Chrysler LLC is scrambling to slash costs and line up partnerships with foreign auto makers to shore up its finances amid a painful downturn in sales and a deteriorating outlook for the company, people familiar with the matter said.

In other words, Chrysler's debt is near worthless and they're scrambling to cut costs. But they're not alone.

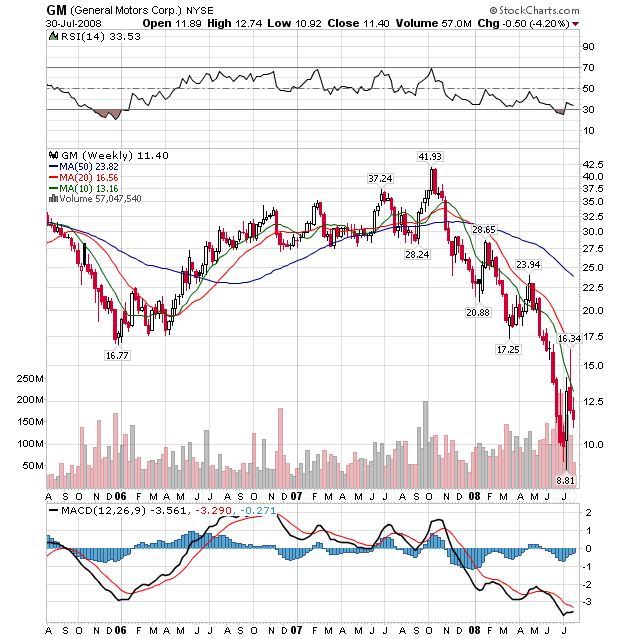

Consider GM. They've lost money three years in a row. More importantly, their book value (total assets - total liabilities) has been negative for the last two years. Their sales record is inconsistent (at best), and their cash flow is weak. In short, this is a terribly run company. And the stock chart shows it:

That's a chart that inspires confidence, isn't it?

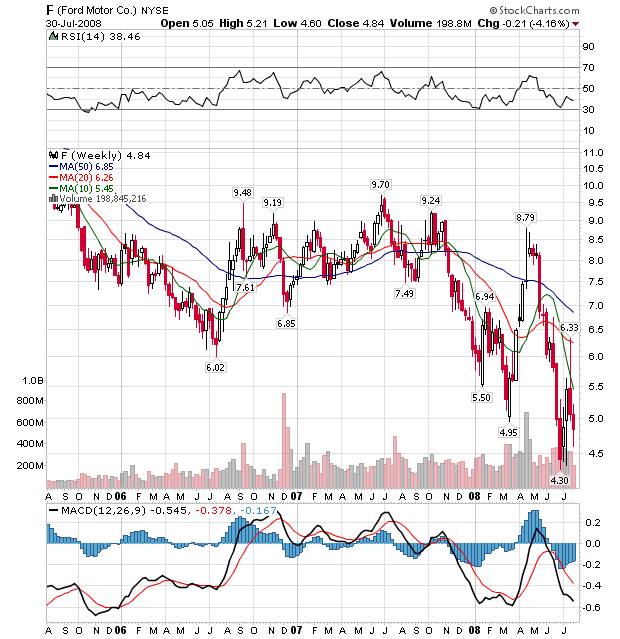

Ford isn't much better. Their book value has been moving around 0 for the last three years. Their sales record is inconsistent. About the only good thing about this company is they have had a positive cash flow for the last three years. But their chart is terrible as well:

So -- why is all of this important? Because as these companies continue to flounder, I'm expecting either GM or Ford or both to hit Congress up for money. Ford has 229,000 full-time employees and GM has 266,000 full time employees. I don't have a break down of their geographic location. Let's assume at least half of them are somewhere in the US. That means 247,500 are US based. There will also be a great call for the need to help an American icon out. Plus -- Congress did it before with Chrysler and it worked out just fine. Finally, the Federal Reserve back-stopped the Bear Stearns deal, so why not the car industry?

No comments:

Post a Comment