In nearly every recorded downturn, slower U.S. demand pulled the rug out from commodity prices. Over time, those cheaper prices for inputs like oil, copper and steel provided the needed push to get things roaring again.

This time, it's the opposite. Crude is beyond the $100 mark. Gold is near $1,000 an ounce, while silver broke above $20 for the first time in 27 years. Base metals like copper are red-hot dear.

Cocoa has flown to its highest spot in 24 years, coffee is at a 10-year peak and sugar is flirting with 18-month peaks.

Wheat prices have soared so high that Italy's government has warned its people to brace for big hikes in pasta prices. No kidding.

Thank China and other emerging markets for these sky-high prices, many experts say. So far, most of the U.S. slowdown is staying in the U.S. Construction abroad is booming and factories are humming. All of these efforts need energy and metals.

Wealth is growing where once there was just poverty. Those seeing some money for the first time in their lives are enjoying better diets.

The Chinese and others are buying more meat, sharply boosting demand for feeds like corn.

They also are driving gas-guzzling cars in ever greater numbers.

So, even as U.S. demand for most commodities is waning, total demand is rising.

"This is the China Syndrome," said Earl Sweet, senior economist at BMO Capital Markets in Toronto. "The U.S. economy is probably in a recession. And that normally would lead to weakening demand for all sorts of things."

"China accounts for 50% or more of the demand growth for copper, aluminum, zinc, lead and steel," said Mike Helmar, director of industry services at Moody's Economy.com.

Add to that India and smaller booming markets. That's where the new demand is coming from.

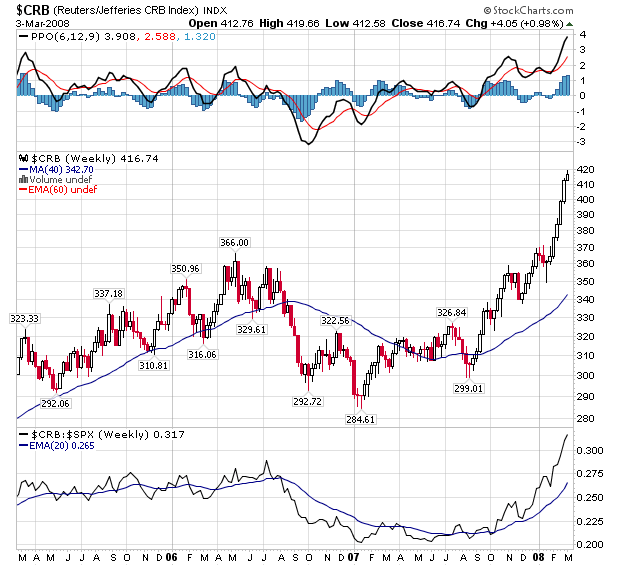

Here's a chart of the CRB overall commodity price index:

No inflation there are all.....

No comments:

Post a Comment