Even as financial firefighters try to douse the flames, the search is under way for the cause of the fire.

How could a mortgage-market meltdown -- losses of perhaps $400 billion, less than 2% of the overall value of the stock market -- cause so much of a disturbance and do so much damage to the U.S. economy? "After all," Federal Reserve governor Frederic Mishkin observed last week, "a 2% decline in stock-market prices sometimes happens on a daily basis, and yet leads to hardly a ripple in the U.S. economy."

And is the fire being fanned by the way commercial banks are required to keep their books and decide how much capital to hold as a cushion against bad times?

The short answer to the first question is leverage. The short answer to the second is yes.

What role do you think leverage and the way banks decide how much capital to hold played in creating the current credit mess? Readers, weigh in.

Leverage is borrowing money to make bigger bets. Invest $1, borrow $9, buy something for $10. If its value rises $2, you've tripled your initial investment. It works great when the market is on the way up. On the way down, it amplifies losses.

.....

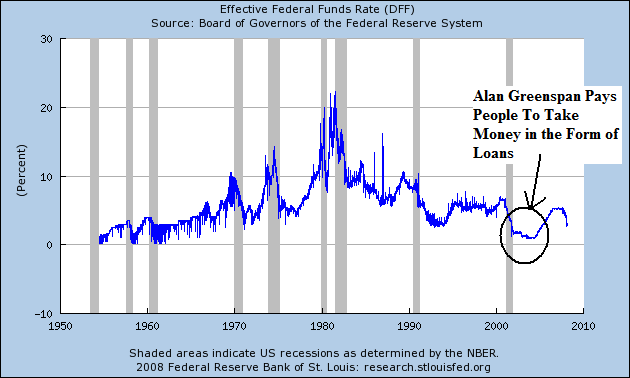

With money cheap, banks gorged themselves with leverage in good times, making not only risky mortgages, but increasing leverage by investing in securities that rested on the riskiest slice of those mortgages. Bank balance sheets now are on a forced diet.

"Banks gorged themselves with leverage in good times." Gee Alan, do you think this:

Had anything to do with that?

No comments:

Post a Comment