The Federal Reserve is losing its grip on prices, suggests the soaring demand for Treasuries that shield investors against inflation.

The difference in yield between 10-year Treasury notes and the 10-year Treasury Inflation-Protected Securities [TIPS] widened to 252 basis points as of Friday, the most since August 2006.

That signals investors expect consumer prices to rise at a 2.52% annual rate over the next 10 years, well above the Federal Reserve's unofficial 1%-2% annual target.

Also, see this post below on the dropping dollar, which is also having an impact around the globe

A rising tide of inflation pressure around the globe is putting more stress on the beleaguered U.S. dollar, as central banks from China to Chile fight rising prices by letting their currencies strengthen.

China's yuan has already appreciated nearly 3% against the dollar this year, putting it on pace to strengthen at more than double last year's rate. Last week, Vietnam relaxed strict controls on its currency, the dong, allowing it to rise more rapidly against the U.S. currency.

In the Persian Gulf, news agency Zawya Dow Jones reported yesterday that the United Arab Emirates is re-examining its currency's peg to the dollar, largely because having a stronger currency would help in its struggle against inflation.

One big source of inflation worries: soaring prices for raw materials. Yesterday, oil closed at a new high of $107.90 a barrel on the New York Mercantile Exchange, jumping $2.75, or 2.6% as more investors piled into the hottest commodity around. Oil's rise is fueling gasoline prices: The average U.S. retail price of a gallon of regular gas rose 6.3 cents to a new high of $3.225 this week, the U.S. Energy Information Administration said yesterday.

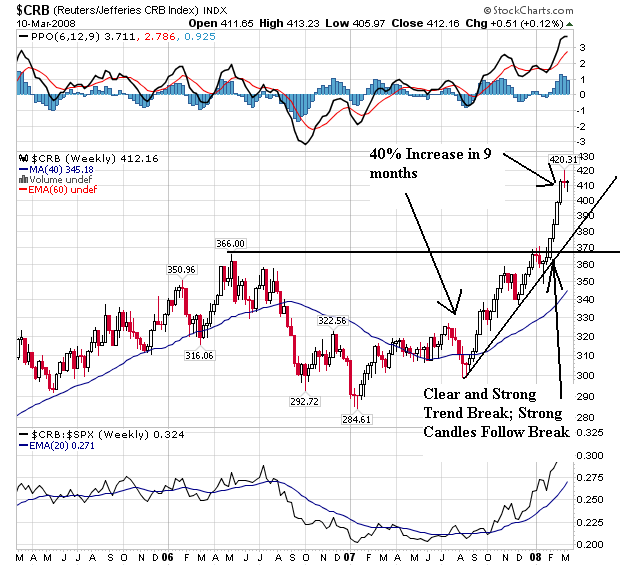

This should not surprise anyone. Consider the CRB chart:

Notice the following:

-- The market has been in a clear rally for the last nine months.

-- The index broke through resistance earlier this year

-- The price bars after breaking through resistance are incredibly strong, indicating prices are moving up at a solid clip.

No comments:

Post a Comment