The stock market is trading right where it was nine years ago. Stocks, long touted as the best investment for the long term, have been one of the worst investments over the nine-year period, trounced even by lowly Treasury bonds.

The Standard & Poor's 500-stock index, the basis for about half of the $1 trillion invested in U.S. index funds, finished at 1352.99 on Tuesday, below the 1362.80 it hit in April 1999. When dividends and inflation are factored into returns, the S&P 500 has risen an average of just 1.3% a year over the past 10 years, well below the historical norm, according to Morningstar Inc. For the past nine years, it has fallen 0.37% a year, and for the past eight, it is off 1.4% a year. In light of the current wobbly market, some economists and market analysts worry that the era of disappointing returns may not be over.

Until last fall, many investors had viewed the bursting of the tech-stock bubble as a nasty but short-term setback. The market had resumed its upward march, reaching new highs in October. Then the credit crisis began weighing on stocks, as did the possibility of a recession. By March 10, the S&P 500 was down 18.6% from its Oct. 9 record close, nearing the 20% decline that signals a bear market. It has rebounded since then amid the Federal Reserve's efforts to stabilize the financial system, but it remains 13.3% below its October record.

Conventional stock-market wisdom holds that if investors buy a broad range of stocks and hold them, they will do better than they would in other investments. But that rule hasn't held up for stocks bought in the late 1990s or 2000.

Over the past nine years, the S&P 500 is the worst-performing of nine different investment vehicles tracked by Morningstar, including commodities, real-estate investment trusts, gold and foreign stocks. Big U.S. stocks were outrun even by Treasury bonds, which historically perform much less well than stocks. Adjusted for inflation, Treasurys are up 4.7% a year over the past nine years, and up 5.8% a year since the March 2000 stock peak. An index of commodities has shown about twice the annual gains of bonds, as have real-estate investment trusts.

This is a really good observation and it raises many troubling questions for the next 5-10 years.

While no one has a crystal ball that sees perfectly (or imperfectly for that matter) there is no denying that current economic conditions are terrible. Our current problems started with a massive real estate glut. Supply and demand are still massively out of whack (see this article) and will be for some time. Anyone who is calling a bottom in housing that occurs before the 4th quarter of this year is engaging in spin rather than analysis.

The real estate problems have infested the US financial system. Simply put, everyone jumped on the real estate bandwagon with the end result being that now everyone is hurting. And there is no reason to think this won't continue for some time. Economic problems are at the heart of the financial systems problems as more and more homeowners stop paying their mortgages or simply walk away because their home's price is now horribly below the total value of the mortgage.

And this is before we get to to heavily indebted consumer who is literally drowning in debt payments. The national government isn't doing much better and state governments are quickly making up for lost time.

There are two charts the bolster the WSJ's points. Here is a 15 year chart of the SPYs. Notice we are clearly on the downside of a possible double top formation with the first top occurring in 2000 and the second occurring in 2007:

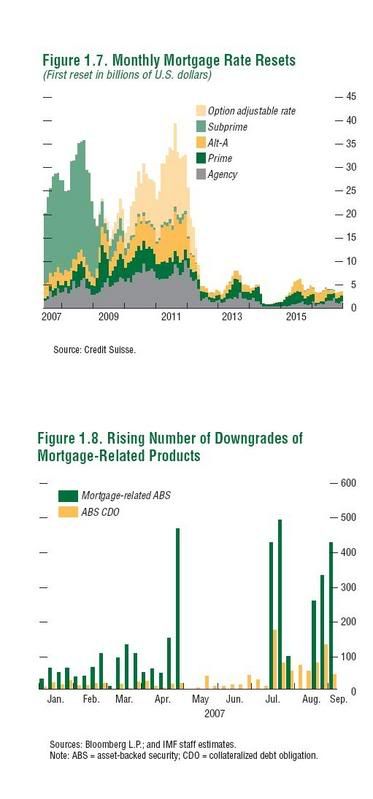

The second chart is the reset chart for the mortgage industry. Notice that we have a second wave of resets that starts in 2010! This means we could experience the exact same situation today that we're experiencing now.

I want to caution -- no one has a crystal ball and the above analysis is largely an extrapolation of current events to the future. But it's also important to remember the long-term chart formation of the SPYs is not good and the underlying fundamental economic backdrop is poor right now with very little positive news filtering through. In short -- things ain't that good right now.

No comments:

Post a Comment