Gold futures broke above the psychologically key level of $1,000 an ounce Thursday, propelled by ongoing dollar weakness and bleak news from the financial sector.

Early Thursday, gold for April delivery soared to a record high of $1,001.50 an ounce on the New York Mercantile Exchange. This was the first time that gold surpassed $1,000 an ounce. Graphic: Timeline of gold's march to $1000.

Later in the session, the gold contract gave up some of its gains and ended up $13.30 at $993.80 an ounce.

"Today's spike will likely become known as the Carlyle/Drake rally," said Jon Nadler, senior analyst at Kitco Bullion Dealers, in a research note.

This is the clearest sign that investor's inflation expectations are very high right now -- and getting higher.

Let's take a look at the charts.

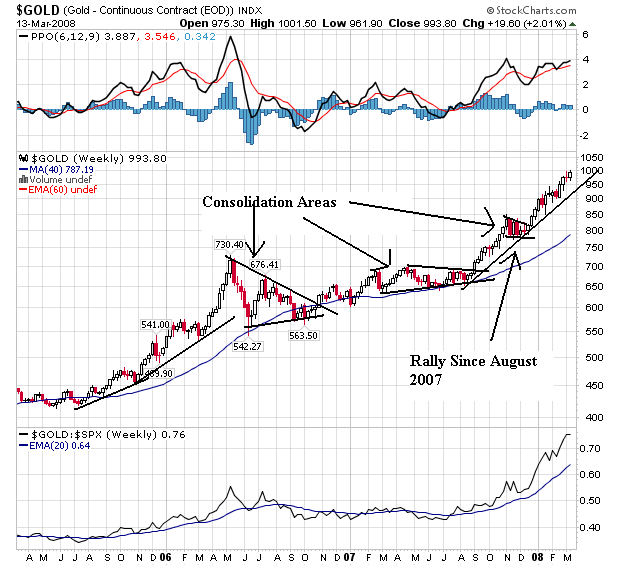

This is a very bullish chart. Notice there aren't any severe price spikes. Instead we have two areas of rising prices -- roughly mid-2005 to mid-2006 and mid-2007 onward -- with a period of price consolidation between them. Also note that prices are consolidated several times. This is a very orderly rise.

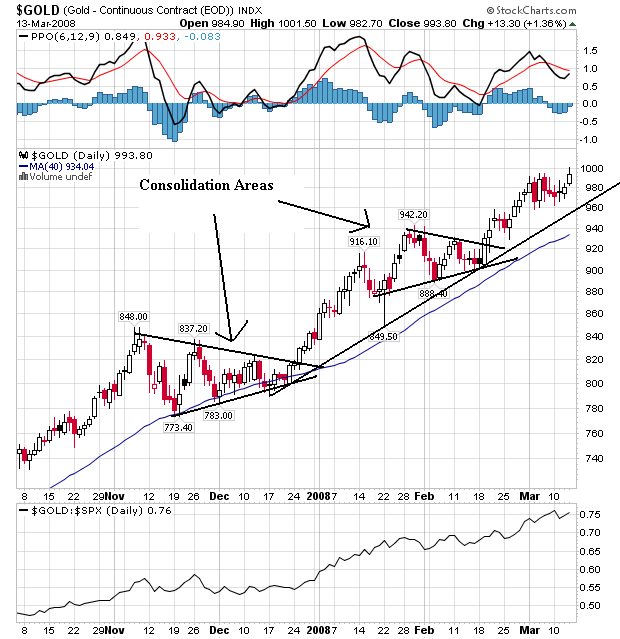

On the daily chart notice again the very disciplined price rise occurring. Prices move, consolidate for at least a month, and then continue to move higher. It's going to take a lot to break this cycle.

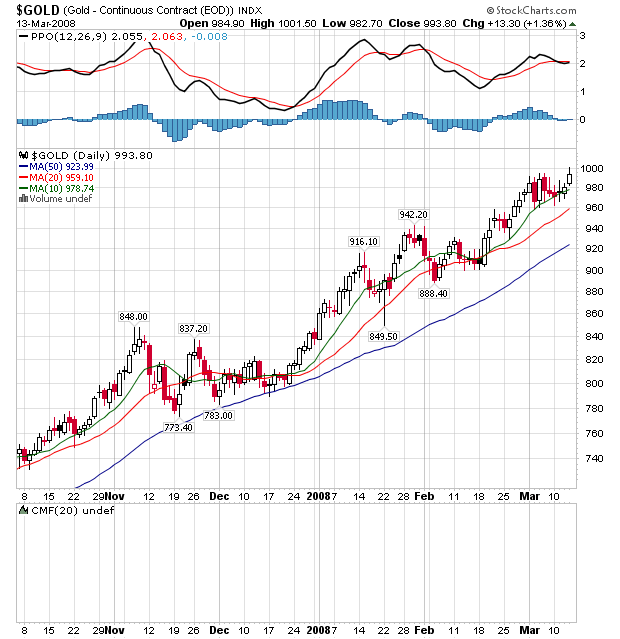

On the daily SMA chart, notice the following

-- Prices have been using the SMAs as support for the last few months

-- The shorter SMAs are above the longer SMAs

-- Prices right now are above the SMAs

-- All the SMAs are moving higher.

No comments:

Post a Comment