With oil prices hovering near record highs and inventories flush, OPEC ministers meeting in Vienna today are all but sure to leave output unchanged. But with so much uncertainty facing the market, the group is likely to meet again in the next few months, amid deep-seated concern about the direction the global economy is taking and the implications for oil demand.

The 13-member Organization of Petroleum Exporting Countries, which supplies 40% of the world's crude, faces a tough dilemma. Were it to cut production at a time of high prices, it could get the blame if the world tips into recession. If it raises output as demand weakens, prices could nose-dive, threatening the group's revenue.

The U.S. made a last-ditch appeal to the cartel to raise output. President Bush said it was a "mistake" to have your biggest customers' economies slowing down because of high crude prices, which he warned could cause people "to buy less energy over time." The U.S. Energy Information Agency said OPEC should raise oil-production levels by between 300,000 and 500,000 barrels per day.

Oil rose nearly 20% in less than one month and trading has been volatile after OPEC signaled it would keep output unchanged. Krista Nonnenmacher, an independent market maker with AMEX, discusses the oil market and geo-political influences.

But the group is likely to sit on its hands. "It seems like there will be no change," Iran's oil minister, Gholam Hussein Nozari, said yesterday after a meeting of the committee that recommends policy decisions to OPEC.

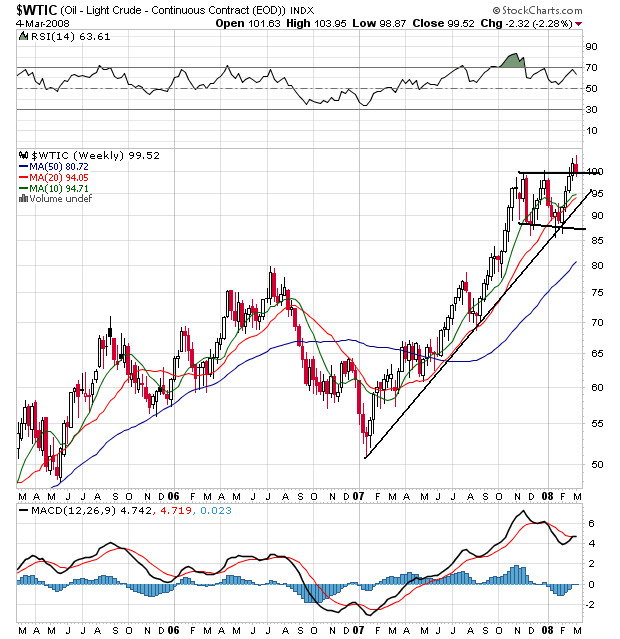

The problem with the US' request is we're no longer OPEC's only big customer. Previously the statement from the US would have had weight. But now 1.3 billion people in China and and 1.1 billion people in India have a higher standard of living. Even if their economies slow there is now more wealth in those countries which increases their demand for oil. As a result, we get price charts like this:

And the US will simply have to get use to prices like this:

No comments:

Post a Comment