So -- what's going on? There are a combination of reasons for the answer.

Let's start with the Fed statement:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 75 basis points to 2-1/4 percent.

Inflation has been elevated, and some indicators of inflation expectations have risen. The Committee expects inflation to moderate in coming quarters, reflecting a projected leveling-out of energy and other commodity prices and an easing of pressures on resource utilization. Still, uncertainty about the inflation outlook has increased. It will be necessary to continue to monitor inflation developments carefully.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Gary H. Stern; and Kevin M. Warsh. Voting against were Richard W. Fisher and Charles I. Plosser, who preferred less aggressive action at this meeting.

1.) Everybody was expecting a 100 basis point cut and we only got a 75 basis point cut. That's why the markets dropped at first after the news came out. So, the Fed didn't cut as much as expected.

2.) Note the inflation language. The Fed is saying, "we're not happy with where inflation is and it could spike higher." In addition,

3.) Two governors voted against the decision. Here's a key phrase from the January 30 meeting:

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred no change in the target for the federal funds rate at this meeting.

One Fed governor voted against that rate cut in January. Two voted against the latest cut.

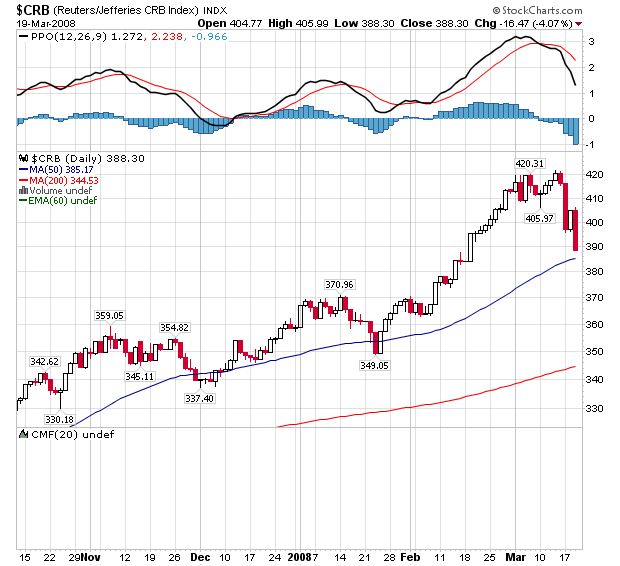

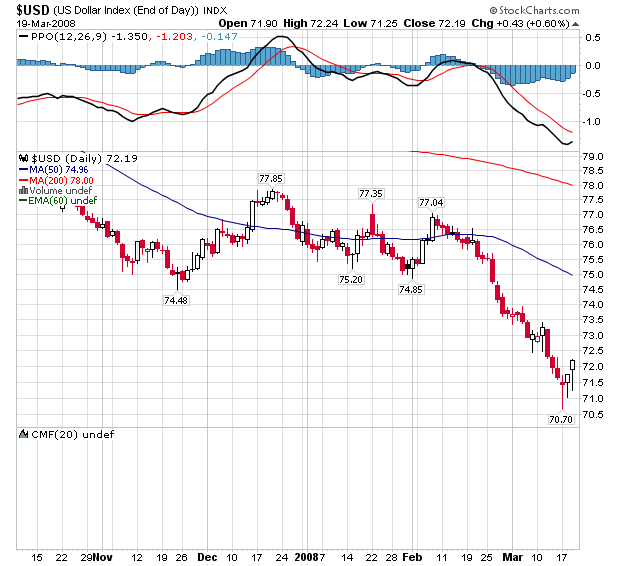

Putting this all together, I think commodities traders are thinking there is growing dissent within the Fed about interest rate policy. The rate cut was smaller than we thought it would be and more Fed governors are voting against cutting rates. Therefore, the rate cuts may be near the end. This would also explain why the dollar is rising the last few days:

Note the action across a variety of fronts:

Gold futures suffered their biggest one-day dollar decline in 28 years and other precious metals also tumbled sharply on long liquidation Wednesday in the aftermath of a smaller-than-expected rate cut from the Federal Open Market Committee that came after metals closed on Tuesday, traders and analysts said.

The selling was part of overall weakness in commodities that included a loss of more than $5 a barrel in Nymex April crude oil as of gold's close. Technical selling was triggered in the metals.

Most active April gold tumbled $59 to $945.30 an ounce on the Comex division of the New York Mercantile Exchange. Shortly after Comex pit trade closed, the April contract at the Chicago Board of Trade was down $59.60 to $945.10.

Lightly traded but nearby Comex March gold fell $58.50 to $944.70 an ounce. A scan of Nymex records shows nearby gold has seldom ever lost more than $30 a day, and Wednesday was the largest one-day fall since a $143.50 collapse on Jan. 22, 1980, the month when gold was especially volatile when hitting record highs that stood until early this year.

Meanwhile, May silver plunged $1.515 to $18.445. As it was closing, CBOT May silver was down $1.508 to $18.47. Comex April gold settled Tuesday at $1,004.30, less than an hour before the FOMC cut the federal-funds rate by 75 basis points rather than the 100 the financial markets were expecting. Furthermore, there were two dissenting votes.

The contract fell as far as $976.80 in electronic screen trading late Tuesday, then tumbled further Wednesday to a pit-session low of $940. At that level, it was down $93.90, or 9.1% from the contract high of $1,033.90 hit two days ago.

The dollar's rally after the rate cut was the catalyst for much of the selling in gold, said Daniel Pavilonis, senior market strategist with Lind-Waldock.

No comments:

Post a Comment