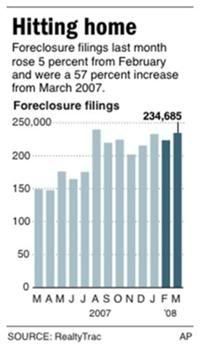

The number of U.S. homes receiving at least one foreclosure filing jumped 57 percent in March to 234,685, compared with 149,150 properties a year earlier. Filings include default notices, auction sale notices and bank repossessions.

The overall foreclosure rate is 5 percent higher than in February, which saw an unexpected month-to-month decline over January. March marked the 27th consecutive month of year-over-year increases in national foreclosure filings.

That meant one in every 538 households received a filing during the month. Forty-four percent were households that slipped into default for the first time and more than a fifth were homes banks took back.

Lenders took possession of homes at a sharply higher rate, up 129 percent over last year, as more homeowners relinquished their homes, said Sharga. Banks repossessed 51,393 properties nationwide, many of them without a public foreclosure auction.

"In a lot of cases, banks worked something out with the owner in advance and took back the keys and deed. For a homeowner, it's not as embarrassing and it's a little less of a blemish on their credit record compared to a foreclosure," Sharga said.

He estimates between 750,000 and 1 million bank-owned properties will hit the market this year, or about a quarter of the homes up for sale. In some areas, these properties will continue to slow sales and depress prices further.

The article had an accompanying graph:

Here's my thought pattern on housing -- and it hasn't changed much over the last 6 months or so.

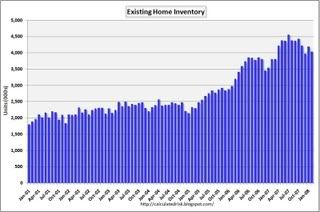

First, there is a ton of inventory on the market. Here is a chart of total existing inventory from Calculated Risk

Notice in the story above economists were predicting 750,000 to 1 million more homes will hit the market in the next year as a result of the increase in foreclosures. That means at minimum we'll see no meaningful drop in inventory over the next year.

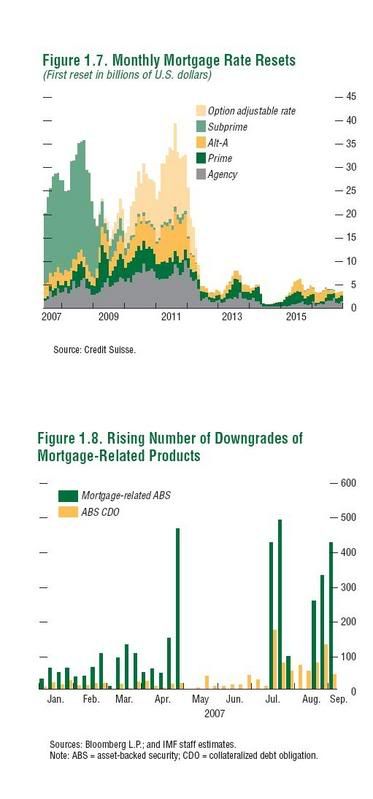

And here is a chart from CSFB that shows we're nowhere near the end of foreclosures related to changing mortgage terms. In fact, we have a second wave to go through in about a year and a half:

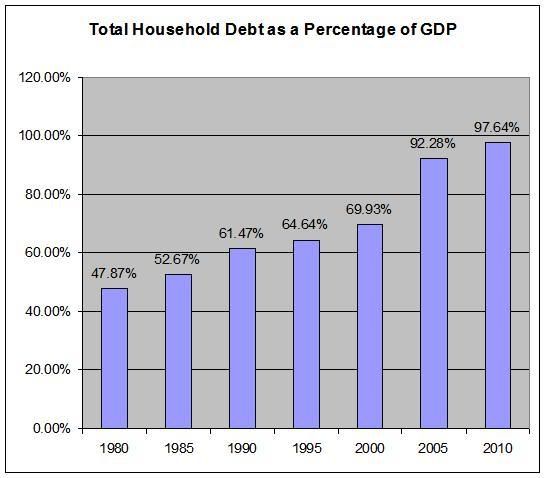

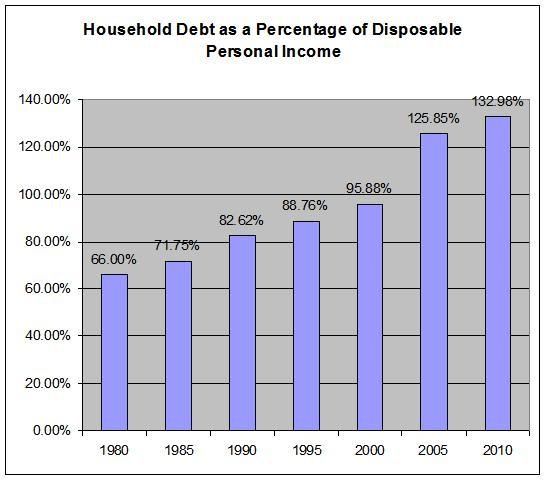

At the same time, the US consumer is in debt up to his eyeballs and can't afford to talk out much more debt.

So -- there is little reason to think inventory will decrease in the coming year and there is little reason to think people will rush into the housing market because they are already under a tremendous amount of debt.

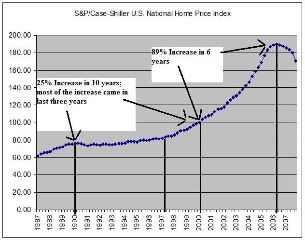

So -- what does that mean for prices? If inventory isn't decreasing and fewer people are able to take out a loan that means prices will have to drop. And considering how out-of-whack home prices are anyway, that shouldn't be much of a surprise:

Compare the 1990s with the 2000s (but also remember we were working on another bubble in the 1990s). Despite the fact that things were good in the 1990 we didn't see a huge increase in prices. However, we made up for lost time in the 2000s. Simply put, prices are going to drop before they move higher.

No comments:

Post a Comment