Frontier Airlines Holdings Inc., the U.S. discount carrier that serves 70 destinations from Denver, filed for bankruptcy protection, becoming the fourth U.S. airline to do so in less than a month.

Frontier took the step after its main credit-card processor began withholding proceeds from ticket sales, it said in a statement today. The carrier pledged to continue flying and keep paying workers while it seeks additional financing.

``We filed for very different reasons than those of other recent carriers,'' Frontier Chief Executive Officer Sean Menke said in the statement. ``Fortunately, we believe that we currently have adequate cash on hand to meet our operating needs while we take steps to further strengthen our company.''

Frontier Airlines has debt of $500 million to $1 billion and about the same in assets, according to Chapter 11 documents filed with the U.S. Bankruptcy Court in Manhattan. A slowing economy and jet fuel costs that have risen 60 percent in a year were blamed for recent filings of Skybus Airlines Inc., Aloha Airgroup Inc. and ATA Airlines Inc.

In Asia, long-haul budget carrier Oasis Hong Kong Airlines Ltd. ceased flying after 17 months on April 9, stranding thousands of people in Hong Kong, the U.K. and Canada. Chairman Raymond Lee cited the spiraling price of fuel for the step.

This is one of the biggest impacts from spiking fuel costs -- spiking transportation costs. Anyone who is not seeing inflation bleeding into every nook and cranny of the economy just isn't looking closely at the big picture.

Howard Lindzon offered some colorful (and deadly accurate) commentary about the airlines:

We are one disaster away from another massive airline bailout ‘crisis’ and other than the airline industry itself, the market could care less. All media eyes are focused on the Bear Stearn’s hearings, but forgets the bazillions the government pissed away after 9/11 saving unsavable businesses and useless executives. NO PAYBACK on those crappy loans.

I am always amazed that our piece of shit Airlines can keep planes in the sky. The same crew of cowboy (they call themselves that)/criminal executives has no incentive to make money.

They have everyone to point fingers at to deflect childlike operating prowess. Unions, Wages, Fuel, Maintenance, Terrorism….

If you are a common shareholder you are being raped.

I am first to be thankful that we are free to fly. It is one of our greatest freedoms, but we need a real plan. Obviously, nationalizing won’t work.

The prices of flying are completely ridiculous. Because it is one of our greatest freedoms, not priviledges, the price should truly reflect the freedom. If anywhere close to true competition existed, ticket prices would be much higher and we would have cheap/workable video conferencing. We would lose Vegas, but let’s face it…Vegas is lame.

He's right about the increasing possibility of a bail-out occurring. Four bankruptcies in a month is a sign there is something really wrong with the current structure of the business.

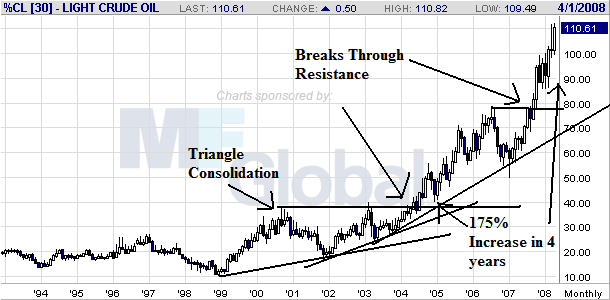

Short version -- the airlines are clearly in very deep trouble right now, and we have the following chart to thank for it:

Let's look at the airline industry charts. Prophet.net breaks them down into two areas -- the majors and the regionals:

The majors were clearly in a funk until mid-2006 when they broke out. The spike in 2007 is probably the result of a merger rumor (although I can't remember exactly what the story was. Anyone who remembers please chime in). But the majors have dropped with the rest of the market since last summer.

The regionals were also in a funk for most of the latest rally. They broke out in late 2006, but broke that trend at the end of last summer along with the rest of the market.

I see no reason to think this sector will do anything except languish for the foreseeable future. Between rising oil and a slowing economy that will diminish traveling, the airlines are getting hit from all fronts.

No comments:

Post a Comment