First, last week's import price number was terrible.

The U.S. Import Price Index increased 2.8 percent in March, the Bureau of Labor Statistics of the U.S. Department of Labor reported today, as higher prices for both petroleum and nonpetroleum imports contributed to the advance. The rise followed 0.2 percent and 1.5 percent increases in February and January. Export prices rose 1.5 percent in March, after advancing 1.1 percent and 1.2 percent for the

prior two months.

The price index for overall imports rose 2.8 percent in March, led by a 9.1 percent advance in petroleum prices. Petroleum prices resumed an upward trend following a 1.9 percent downturn in February. Prices for petroleum rose 60.0 percent for the year ended in March following a comparatively modest 3.1 percent rise over the previous 12-month period. A 1.1 percent increase in nonpetroleum prices also contributed to the overall rise and was the largest one-month increase for the index since nonpetroleum prices were first published on a monthly basis in December 1988. The price indexes for overall imports and nonpetroleum imports also advanced for the March 2007-08 period,increasing 14.8 percent and 5.4 percent, respectively.

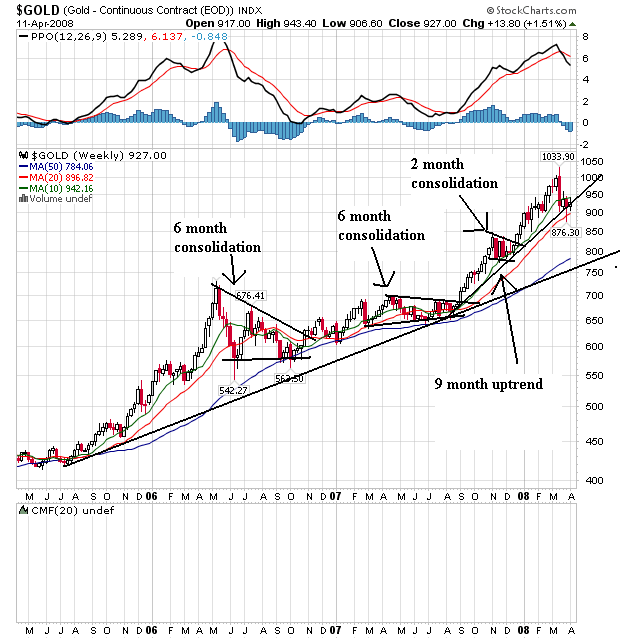

Inflation expectations are far from grounded, as represented by gold:

The market has been rising for about three years. It has continually moved higher, consolidated and continued its upward move. Also notice how it has used the 10, 20 and 50 SMA for support at various times.

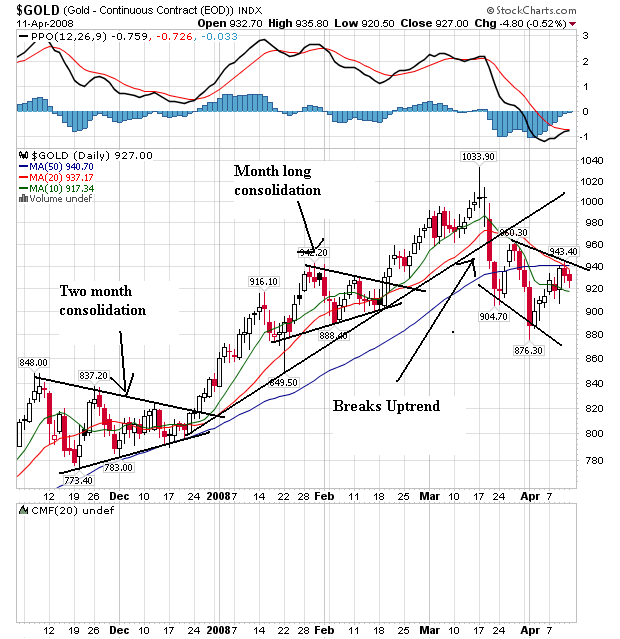

On the daily chart notice the following:

-- Prices recently broke a two month uptrend

-- Prices are moving in a downward channel

-- The 10 and 20 SMA crossed below the 50 day SMA

-- Prices just bounced off the 50 day SMA

This chart could indicate that traders are backing off gold for now. But put this chart in context with the longer term chart above. We'd need to see a lot more technical damage before we could say expectations had reversed.

But most importantly, we're seeing food riots across the globe and requests for help:

The president of the World Bank on Sunday urged immediate action to deal with mounting food prices that have caused hunger and deadly violence in several countries.

Robert Zoellick said the international community has "to put our money where our mouth is" and act now to help hungry people. "It is as stark as that."

He called on governments to rapidly carry out commitments to provide the U.N. World Food Program with $500 million in emergency aid it needs by May 1.

"It is critical that governments confirm their commitments as soon as possible and others begin to commit," Zoellick said. Prices have only risen further since the WFP issued that appeal, so it is urgent that governments step up, he said.

Clearly there are shortages in a lot of places right now. Shortages usually have a way of spiking prices further.

Also see this article from the front page of today's WSJ:

Finance ministers gathered this weekend to grapple with the global financial crisis also struggled with a problem that has plagued the world periodically since before the time of the Pharaohs: food shortages.

Surging commodity prices have pushed up global food prices 83% in the past three years, according to the World Bank -- putting huge stress on some of the world's poorest nations. Even as the ministers met, Haiti's Prime Minister Jacques Edouard Alexis was resigning after a week in which that tiny country's capital was racked by rioting over higher prices for staples like rice and beans.

As food prices soar, protests are breaking out around the world, including this riot Saturday in Port-au-Prince, Haiti.

Rioting in response to soaring food prices recently has broken out in Egypt, Cameroon, Ivory Coast, Senegal and Ethiopia. In Pakistan and Thailand, army troops have been deployed to deter food theft from fields and warehouses. World Bank President Robert Zoellick warned in a recent speech that 33 countries are at risk of social upheaval because of rising food prices. Those could include Indonesia, Yemen, Ghana, Uzbekistan and the Philippines. In countries where buying food requires half to three-quarters of a poor person's income, "there is no margin for survival," he said.

Also see this post from last week.

No comments:

Post a Comment