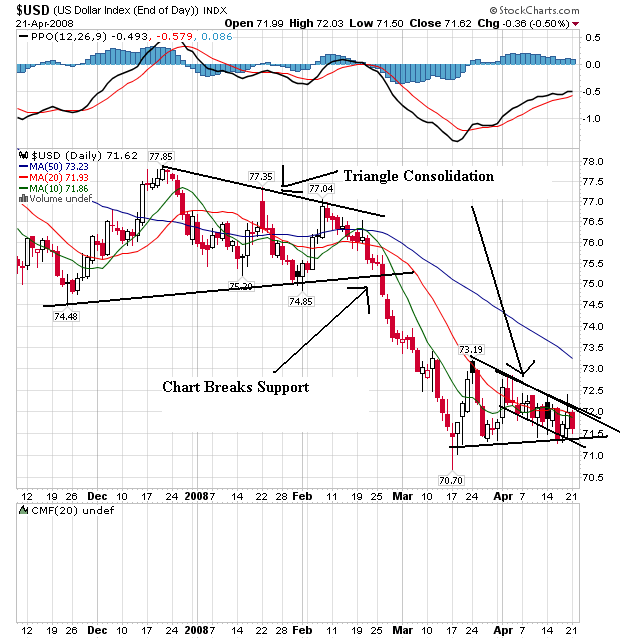

Notice the dollar was in the middle of consolidation pattern from late November 2007 to late February 2008. The dollar fell through support at this time and has since been in the middle of another consolidation pattern between 71 and 73. Prices and the 10 and 20 day SMA are bunched up at this level, indicating traders don't have a firm idea about where they want to send the dollar.

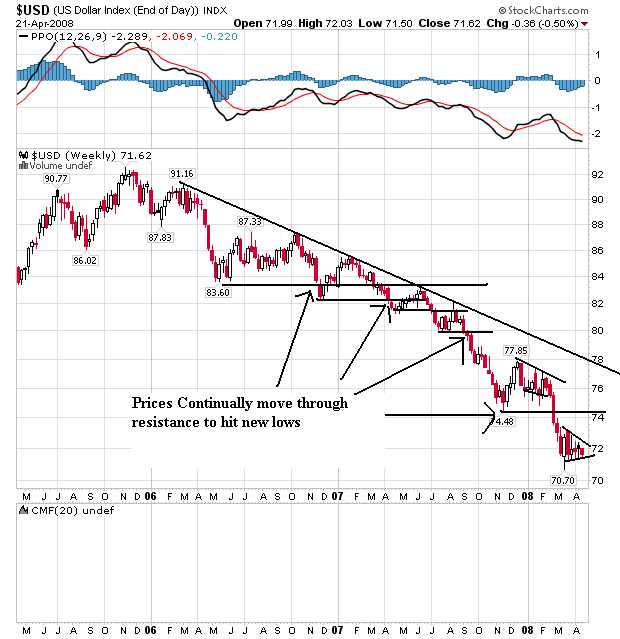

On the weekly chart, notice a clear bear market. Prices are clearly moving lower and have been for the last two years. Prices have continually moved through support to make new lows. Currently the market is forming a triangle consolidation pattern.

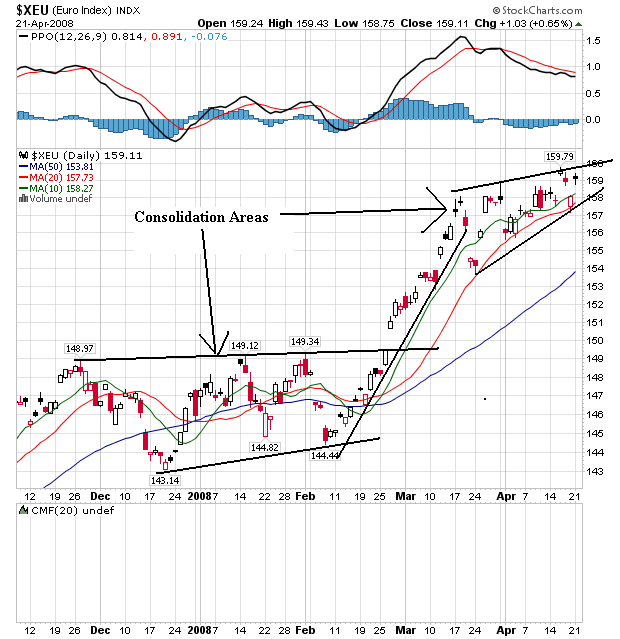

On the euro's daily chart, notice how it is nearly a mirror image of the dollar's chart. The euro consolidated from late November to late February, broke through upside resistance and has formed a consolidation triangle pattern over the last month or so. Prices and SMAs are both moving higher, although they are also a bit bunched indicating a lack of direction.

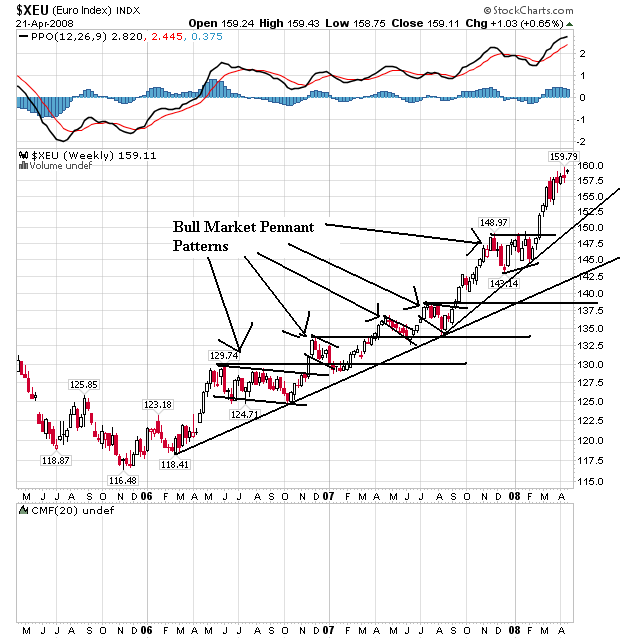

Here we also have a near exact opposite of the dollar. Prices have continually moved higher. There are pennant consolidation patterns along the way and prices have continually moved through upside resistance.

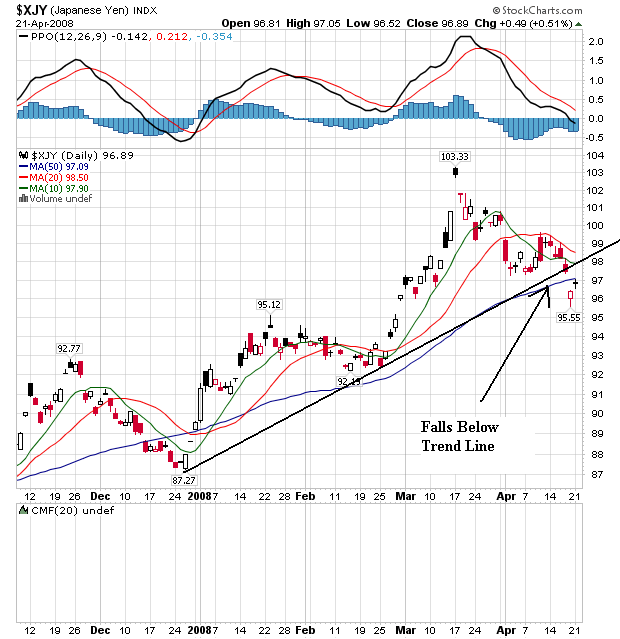

On the daily yen chart, notice that prices have broken through support. However, they still are around the 50 day SMA level where they were at the end of December. However, this is the last area of support for the yen, so if it wants to keep in it's rally it has to, well, start rallying from this level sometime soon.

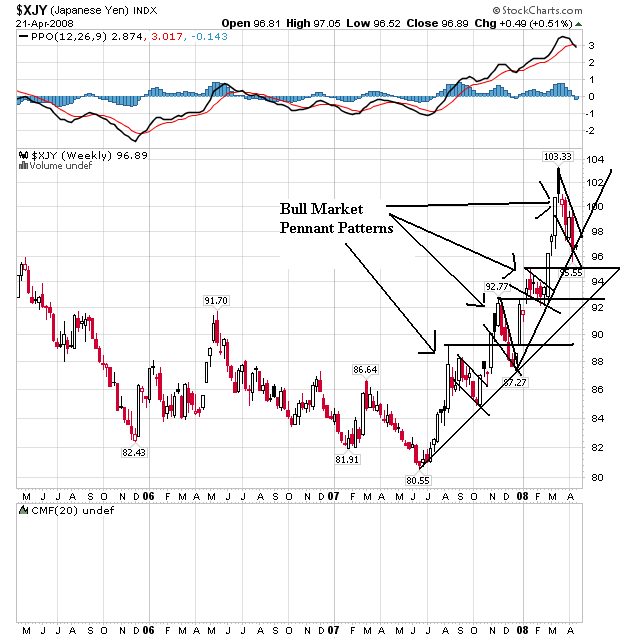

On the weekly chart, notice that prices have been rallying hard for nearly a year. They have continually moved through price resistance levels and formed bull market pennant consolidation patterns. However, compare the slope of the yen and euro rally. The yen rally is incredibly sharp whereas the euro's is more gentle. Gentle rallies are better over the long run.

No comments:

Post a Comment