The Federal Reserve's interest-rate cuts last month have failed to lower borrowing costs for many companies and households, increasing the chance of further reductions from the central bank.

Companies are paying more to borrow now than before the Fed reduced its benchmark rate by 1.25 percentage point over nine days in January, based on data compiled by Merrill Lynch & Co. Rates on so-called jumbo mortgages, those above $417,000, have increased in the past month, making it tougher to sell properties and risking further price declines.

``It's the clogging up of the credit markets that worries me most,'' Harvard University economist Martin Feldstein said in an interview in New York. ``The Fed has done a lot of cutting, the question is whether it's going to get the traction that it did in the past.''

Banks and investors are demanding greater compensation for offering credit as losses mount on subprime-mortgage securities and concerns grow that ratings of bond insurers will be cut. Elevated borrowing costs mean Fed Chairman Ben S. Bernanke will have to reduce rates further to revive the economy, Fed watchers said.

``The problem is that every piece of news we're getting continues to be bad,'' said Stephen Cecchetti, a former New York Fed bank research director, and now a professor at Brandeis University in Waltham, Massachusetts. ``They will have to ease more. It's the only thing they can do.''

Let's take this a bit slower to see what is really going on.

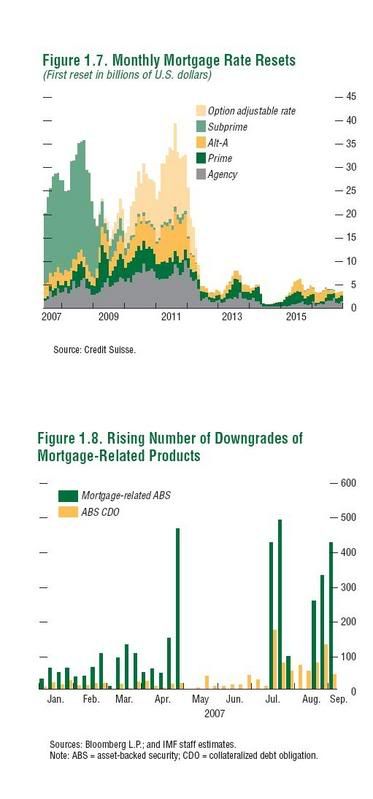

The Fed cut rates 1.25% in January. But the interest rate on loans is increasing. That tells us a very important fact. Lenders are scared out of their minds about further losses from new loans. With all of the writedowns we have seen already, lenders are reeling from problems. They are not in a position to make a ton of loans -- it's that simple. As a result, they are demanding higher interest rates. In addition, I'm guessing that some lenders have realized they seriously under-priced risk and are now figuring out that even a good credit risk is more risky than has been priced in the last few years.

I'm also guessing that banks are looking down the road:

And not liking what they are seeing.

No comments:

Post a Comment