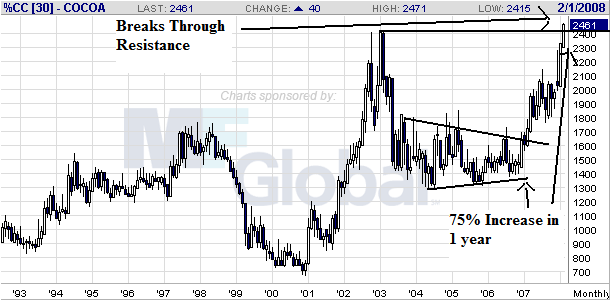

Chocolate makers, already beset by escalating dairy prices, are likely to encounter a bittersweet Valentine's Day. The culprit: a recent surge in the price of cocoa.

Raw cocoa futures for March delivery closed up $33 at $2,454 a metric ton on Wednesday, after reaching as high as $2,471 a ton. The gains on New York's IntercontinentalExchange punctuate a steep run that in the last three weeks has pushed the near-term contract to its highest closing level since April 1985.

Here's a chart of cocoa:

From Marketwatch:

Gold finished slightly lower Wednesday, as platinum soared to a new record high over $2,000 an ounce, fuelled by ongoing worries about declining supply from South Africa, the world's biggest platinum producer.

Platinum for April delivery surged to a new record of $2,001.40 an ounce on the New York Mercantile Exchange. The contract rallied $61.90 to end at $1,983.70 an ounce.

Here's the chart of platinum

From Bloomberg:

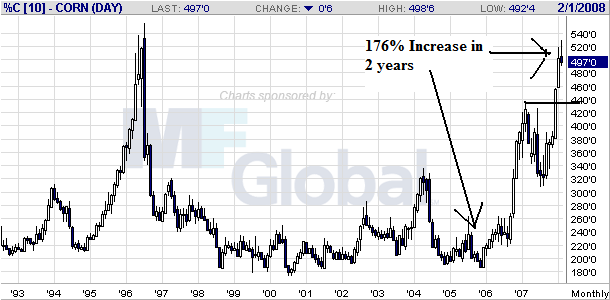

Corn fell for the third straight day on speculation that overseas demand for the biggest U.S. crop is slowing after prices climbed to records last week.

Advance sales of corn for delivery before Aug. 31 are up 33 percent in the past five months from a year earlier to a record 47.4 million metric tons, the U.S. said on Feb. 7. Confidence in the global economy fell for a third month in February as the slowdown in the U.S. spread to Europe and Japan, a Bloomberg survey showed.

``End-users are already well covered on their needs for this year and will slow purchases after the run up in prices,'' said Don Roose, president of U.S. Commodities Inc. in West Des Moines, Iowa. ``News of demand slowdowns always follows the market after these kinds of rallies.''

Here's the chart of corn

Note that I've highlighted spiking prices in a variety of commodities -- oil, wheat, soybeans and gold just to name a few. This means we're not looking at a supply disruption in one commodity that is driving prices of that particular commodity higher; instead, we're looking at system wide price spikes.

No comments:

Post a Comment