There isn't much we can do. Any solution would create a moral hazard, meaning the solution would encourage the behavior that got us into this mess in the first place. To illustrate this point, let's take a quick look at what got us into this mess.

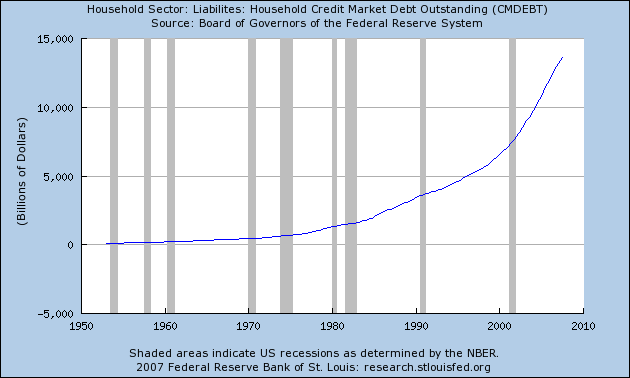

This expansion is characterized by a massive expansion of household debt. First, here is a chart of total household debt outstanding going back a few decades.

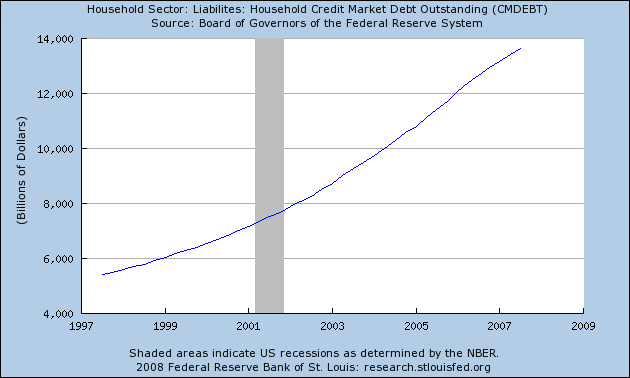

Here is the same chart for the last 10 years.

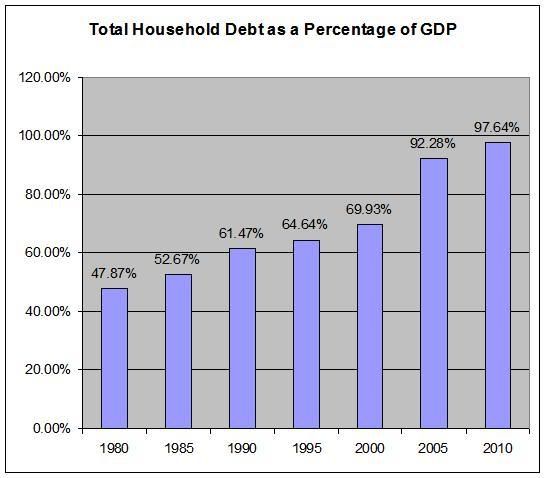

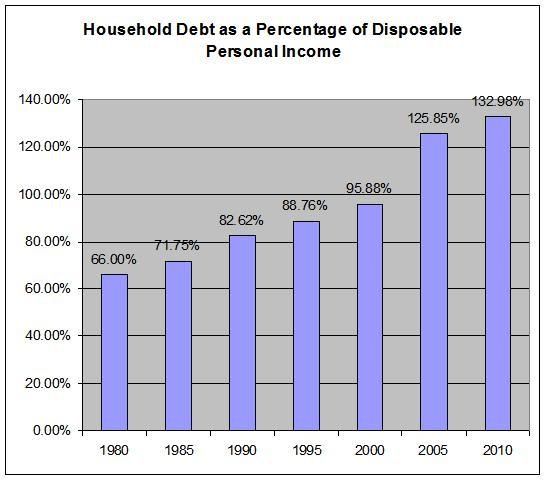

To put all of this debt in perspective, here are two graphs.

So, we have almost as much household debt as we do national product, and we have more dent than we have disposable income.

In other words -- we are awash in debt.

All of this debt has to go somewhere. That's where all of the securitizations you've heard about come into play. Here is a definition from Wikipedia:

Securitization is a structured finance process in which assets, receivables or financial instruments are acquired, classified into pools, and offered as collateral for third-party investment.[1] It involves the selling of financial instruments which are backed by the cash flow or value of the underlying assets.[2]

Securitization typically applies to assets that are illiquid (i.e. cannot easily be sold). It is common in the real estate industry, where it is applied to pools of leased property, and in the lending industry, where it is applied to lenders' claims on mortgages, home equity loans, student loans and other debts.

All assets can be securitized so long as they are associated with a steady amount of cash flow. Investors "buy" these assets by making loans which are secured against the underlying pool of assets and its associated income stream. Securitization thus "converts illiquid assets into liquid assets"[3] by pooling, underwriting and selling their ownership in the form of asset-backed securities (ABS).[4]

Securitization utilizes a special purpose vehicle (SPV) (alternatively known as a special purpose entity [SPE] or special purpose company [SPC]) in order to reduce the risk of bankruptcy and thereby obtain lower interest rates from potential lenders. A credit derivative is also generally used to change the credit quality of the underlying portfolio so that it will be acceptable to the final investors.

Securitization has evolved from tentative beginnings in the late 1970s to a vital funding source with an estimated total aggregate outstanding of $8.06 trillion (as of the end of 2005, by the Bond Market Association) and new issuance of $3.07 trillion in 2005 in the U.S. markets alone.[citation needed]

So all of the household debt has been carved and sold to, well, everybody.

As this process accelerated the entire financial system became very lax in literally everything they did. Mortgage brokers stopped performing due diligence -- meaning they stopped making credit checks. Investment banks who bought collateral to securitize stopped performing in-depth analysis of the assets they were purchasing. Ratings agencies totally dropped the ball in their analysis of the collateral, instead giving literally every single piece of paper a AAA rating so anybody could buy it. Investors who bought this paper didn't look under the hood at the collateral either. In short -- everybody dropped the ball.

The problem we're running into now is we're discovering that all of this debt isn't as valuable as we thought it was for a variety of reasons. Either the value of the collateral backing the loans is decreasing in value (declining home values) or people are increasingly not paying their bills (increasing delinquencies). As a result, the entire financial system is experiencing a huge "revaluation of risk" which simply means they are having to writedown the value of all these securitized assets on their books. This is what Bernanake was talking about yesterday.

As the concerns of investors increased, money center banks and other large financial institutions have come under significant pressure to take onto their own balance sheets the assets of some of the off-balance-sheet investment vehicles that they had sponsored. Bank balance sheets have swollen further as a consequence of the sharp reduction in investor willingness to buy securitized credits, which has forced banks to retain a substantially higher share of previously committed and new loans in their own portfolios. Banks have also reported large losses, reflecting marked declines in the market prices of mortgages and other assets that they hold. Recently, deterioration in the financial condition of some bond insurers has led some commercial and investment banks to take further markdowns and has added to strains in the financial markets.

In short, the financial sector is feeling the pain of their complete lack of due diligence for the last 7 years. Now they are going to Congress asking for a bail-out. The problem is this: any bailout will only encourage this kind of behavior all over again. And that is something we have to avoid to prevent this from happening again.

Now -- this policy prescription means the following: the US economy will perform -- at best -- at a sub-par level for a while. It also means we risk the possibility of a recession. There is this fundamental belief -- encouraged by Alan Greenspan's policies -- that an economy does not have to feel pain. Nothing could be further from the truth. The only way to clean out the dead wood is to clear the way for them to report massive losses and possible go bankrupt. That's how you solve the problem.

What the Fed should be doing right now is ensuring that prices don't get out of control so that on the other side of a recovery the economy is not faced with inflationary pressures. That way when we get out of this mess we'll be able to resume a period of solid growth.

No comments:

Post a Comment