"We are seeing our U.S and European customers becoming increasingly cautious," Chambers said on a conference call with analysts. "We did see the slowdown occur pretty rapidly between December and January."

He also said that India and China remain strong and that "if the market does continue to slow, we do not believe this will dramatically change our long-term opportunities."

But investors have grown increasingly worried that the U.S. economy might slip into a recession, on reports of higher unemployment and a sharp decline in the services sector. Some fear the economic slowdown is spreading to other parts of the globe. Cisco said its orders rose just 8% in Europe last quarter vs. 20% in the previous quarter.

EDS Also Disappoints

On the conference call, Chambers forecast revenue of about $9.7 billion to $9.8 billion for the current quarter ending in April. Analysts were expecting $10.2 billion. Tech services company EDS, (EDS) also reporting results after the close of regular trading Wednesday, issued tepid guidance. Its shares were down about 5% after hours.

24/7 Wall Street puts the above information in perspective.

Cisco (NASD: CSCO) and EDS (NYSE: EDS) have businesses which point different directions on a compass. But, it is the same compass. In one day, Cisco was able to show that large capex tech spending was slowing while EDS said that the consulting business aimed at data center out-sourcing was in the dumps.

To put a point on it, the whirlpool of falling tech earnings is pulling in almost every company in the sector. Reason did not prevail among those who hoped that large companies would continue to put money into next-generation upgrades of existing hardware and software. That puts the need for consulting services well out of consideration for most firms.

Why listen to Cisco? According to Yahoo finance, they are the largest player in the networking and communication devices by a wide margin. Their market cap is $140 billion with the next largest being Juniper Networks at $16 billion. And there is also this nugget (from IBD):

Investors look to Cisco for a fresh take on the economy. It's the first major tech company to give results for fiscal quarters that end in January.

But more importantly, this gives us an opportunity to look at a part of GDP we haven't talked about at all -- equipment and software investment and national GDP.

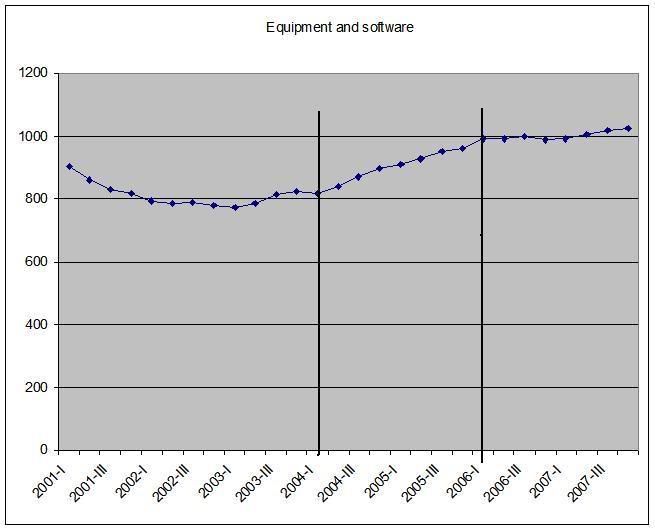

According to the Bureau of Economic Analysis, E&S investment totaled $1.026 trillion in the 4th quarter of 2007, which total national GDP was $14.080 trillion, making E&S investment about 7.28% of the overall economy. E&S investment is twice the size of non-residential construction investment, meaning technology investment is pretty important.

Above is a chart of the total dollar value of E&S investment from the BEA. Notice the real gains for this area of the economy occurred between the second quarter of 2004 and the second quarter of 2006 when the total dollar investment increased from about $800 billion to $1 trillion. Also note that from 2Q03 to 2Q04 there was also an increase, but not as strong as the following two year period.

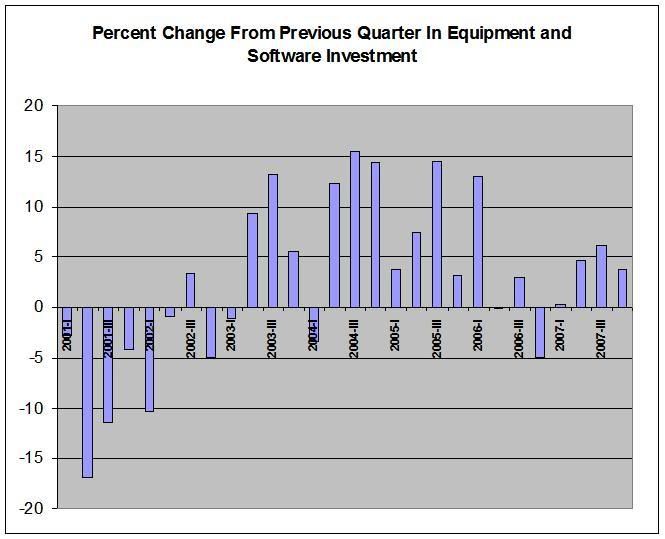

Above is the percent change from the previous quarter in E&S investment. What this chart shows is it appears the really strong investment in E&S occurred earlier in this expansion, from roughly 2003 - 2005. That's when we see big month over month percent change increases. Since then, we've see growth but not as strong as earlier in the expansion.

Cisco's warnings indicate that on the percentage change from the previous month we may be looking at another down month.

No comments:

Post a Comment