From the WSJ:

Stock markets nudged higher despite a pullback among financial stocks led by bellwether American International Group, which fell sharply after detailing its recent difficulties in valuing complex credit instruments.

The Dow Jones Industrial Average ended up 57.88 points Monday, up 0.5%, at 12240.01, supported by gains in components such as General Motors, which advanced by 5.1%, and Home Depot, which gained 2.6%. On the year, the Dow is off 7.7%.

AIG, also a Dow component, plummeted 11.7% after it acknowledged that its credit-derivatives portfolio lost $4.88 billion in gross market value in October and November, more than four times the $1.15 billion executives had estimated in December. AIG's auditor, Pricewaterhouse Coopers, advised the company that a "material weakness" exists in AIG's internal controls over financial reporting and oversight regarding the credit instruments.

From the WSJ:

Securities tied to student loans, another seemingly safe corner of the credit markets, are succumbing to the credit crunch.

Wall Street's financial-engineering machine bundles together long-term student loans and uses them as collateral for short-term investments owned by money-market investors. Since Thursday, auctions of these securities conducted by Goldman Sachs Group Inc., J.P. Morgan Chase & Co. and Citigroup Inc. have failed to generate investors' interest, leaving roughly $3 billion of such securities in a sort of limbo.

Under normal conditions, the banks would step in when investor demand is weak -- just as a specialist on the New York Stock Exchange intervenes to keep trading liquid in a stock. Because big banks are already bloated with other kinds of loans and bonds they are trying to get rid of, they have been allowing the auctions to fail.

That, in turn, is pushing up interest rates for the securities and leaving them in the hands of investors who might have intended to get rid of them.

From Bloomberg:

Credit Suisse Group, Switzerland's second-biggest bank, said fourth-quarter profit fell 72 percent on lower earnings at the securities unit after writedowns of 1.3 billion Swiss francs ($1.2 billion) on debt and leveraged loans.

Net income dropped to 1.33 billion francs, or 1.21 francs a share, the Zurich-based bank said in a statement today. That missed the 1.43 billion-franc median estimate of 11 analysts surveyed by Bloomberg. Credit Suisse declined as much as 4.9 percent in Swiss trading.

Credit Suisse's markdowns in the quarter compare with $14 billion at UBS AG, the country's biggest bank, and 44 million euros ($64 million) at Frankfurt-based Deutsche Bank AG. Chief Executive Officer Brady Dougan scaled down U.S. subprime- mortgage related holdings before a debt-market slump led to more than $145 billion in writedowns and loan losses at the world's biggest financial institutions.

I am officially going of the record with this statement: the financial sector is pure investment poison right now. Most investors should avoid it like the plague.

Don't believe me? Let's look at the charts.

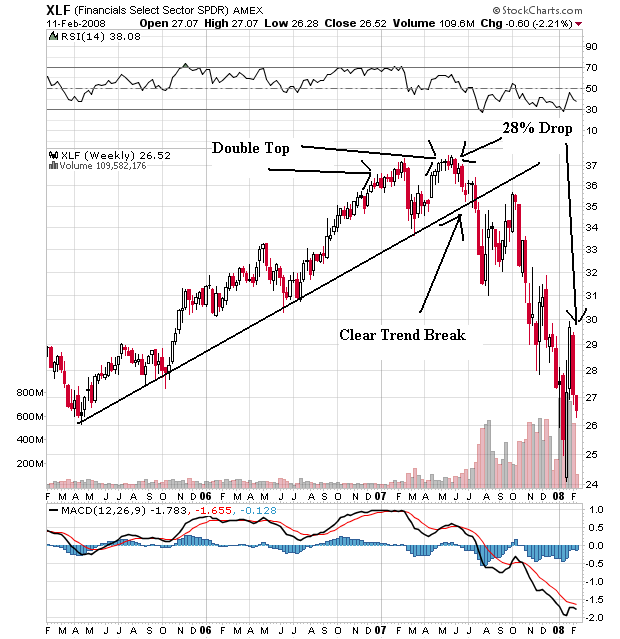

Above is a weekly chart of the XLF. Notice the following:

-- The index was in a two year uptrend that started in 2Q2005.

-- The index formed a clear double top in 1Q2007 and 2Q2007

-- The index broke that trend in 3Q2007

-- The index has lost 29% (rounded) since its peak in 2007.

And the losses show no signs of abating.

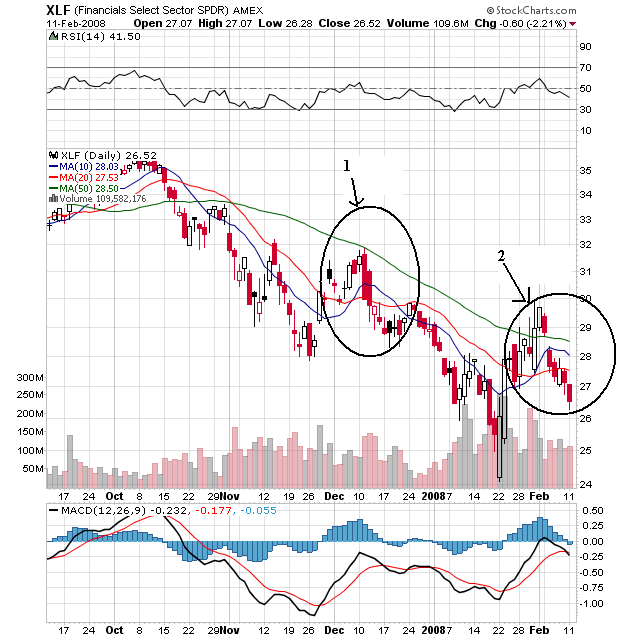

I circled two areas because they are clearly analogues.

In situation 1, prices rose through the 10 and 20 day SMA, bounced off the 50 day SMA and then went lower. This action pulled the 10 day SMA higher through the 20 day SMA. This in turn evened out the 20 day SMA for about a month. Prices resumed their lower move.

In situation 2, prices rose through the 10 and 20 day SMA, moved through the 50 day SMA and then went lower. This action pulled the 10 day SMA higher through the 20 day SMA. This in turn evened out the 20 day SMA for about half a month. Prices continued their lower move.

Ladies and gentlemen, we're nowhere near done with this stuff. Consider the following loss predictions: (ht Calculated Risk)

November 16 2007:

The slump in global credit markets may force banks, brokerages and hedge funds to cut lending by $2 trillion and trigger a ``substantial recession'' in the U.S., according to Goldman Sachs Group Inc.

Losses related to record home foreclosures using a ``back- of-the-envelope'' calculation may be as high as $400 billion for financial companies, Jan Hatzius, chief U.S. economist at Goldman in New York wrote in a report dated yesterday. The effects may be amplified tenfold as companies that borrowed to finance their investments scale back lending, the report said.

``The likely mortgage credit losses pose a significantly bigger macroeconomic risk than generally recognized,'' Hatzius wrote. ``It is easy to see how such a shock could produce a substantial recession'' or ``a long period of very sluggish growth,'' he wrote.

December 18, 2007:

Merrill Lynch may have laid down a new high-water mark for estimated losses on mortgages across all investors and institutions, pegging the ultimate tally at $500 billion.

Feb. 10, 2008:

Senior global policymakers have raised projections for the size of subprime-related credit losses in a move that implies financial institutions will have to increase write-offs.

Speaking after the meeting of Group of Seven finance leaders, Peer Steinbrück, German finance minister, said the G7 now feared that write-offs of losses on securities linked to US subprime mortgages could reach $400bn.

To date, 225 mortgage lenders have imploded.

So far -- we've only seen about $100 - $110 billion in writedowns. Compare this to the lowest estimate of total losses of $400 billion listed above.

This is just getting started.

No comments:

Post a Comment