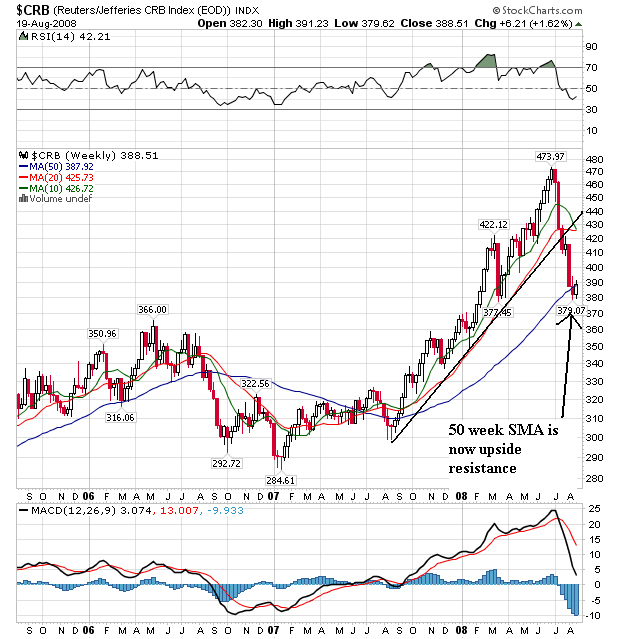

Let's start with the macro-level view:

-- The CRB started to rally at the end of last summer, and has risen about 58% from low to high.

-- The CRB clearly broke that trend earlier this month, signaling a new trend (or at least a consolidation).

-- Prices are now below all three weekly SMAs

-- The 10 week SMA is about to cross below the 20 week SMA. Remember -- these are weekly SMAs, so it takes longer for them to move. But when they do move the moves are that much more important

-- The 50 week SMA is now acting as resistance as opposed to technical support.

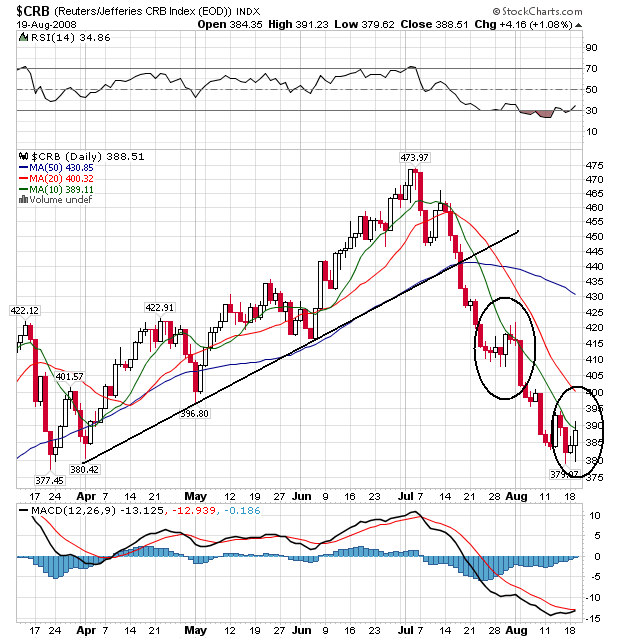

On the daily chart, notice the following:

-- Prices are below all the SMAs

-- All the SMAs are headed lower

-- The shorter SMAs are below the longer SMAs

-- In two instances over the last month, the 10 day SMA has provided upside resistance as opposed to support. This is a bearish development for the index

Bottom line -- this market is clearly in a solid correction. The main question now is how long until this starts to show up in CPI/PPI numbers.

No comments:

Post a Comment