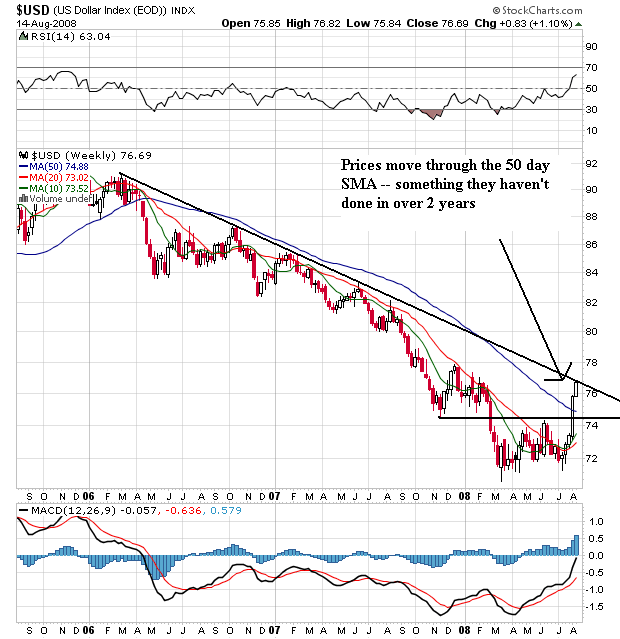

Notice the following:

-- Prices broke above the 50 week SMA -- which they have not done for over 2 years. Also note the strength of the bar they printed on -- there was a huge rally last week which this week's action is pulling higher.

-- The 10 week SMA is now above the 20 week SMA

-- Prices are now above a low established at the end of 2007 providing more technical proof of a break-out rally.

-- Prices are right below the long-term downward sloping trend line that has provided upside resistance to the dollar for the last two and a half years.

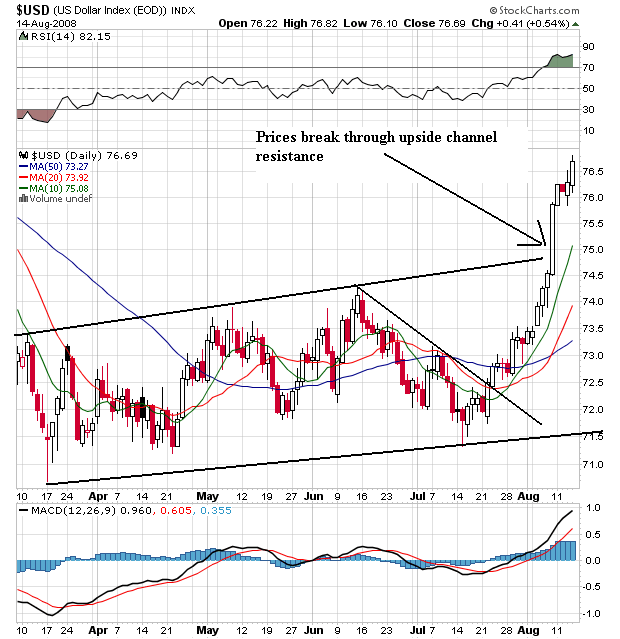

On the daily chart of the dollar, notice the following:

-- Prices have broken through the upside channel line established in March of this year.

-- The SMAs are breaking into a very bullish pattern, with

-- The shorter SMAs higher than the longer SMAs

-- All the SMAs moving higher

-- Prices above all the SMAs

The P&F chart shows us there is tremendous upside resistance at various levels in the low 80s. So the next move for the dollar will be one of two things.

1.) Continue higher and attempt to break through the upside resistance in the lower 80s, or

2.) Move lower and test important technical support levels to confirm we're in a rally.

So -- why is the dollar rallying?

This is not so much of a dollar rally as it is a drop in the value of other currencies. Let me explain that statement.

There are two reasons why a person would purchase a currency.

1.) The interest rate differential. If interest rates are higher in one country than the other traders/investors will purchase interest yielding assets in the country with higher interest rates. This is not the case with the current situation. The US 10-year government bond is currently yielding 3.88% while the German 10-year is yielding 4.19%, the UK 10-year is yielding 4.58% and the Australian 10 year is yielding 5.85%.

2.) The economy is growing and is therefore good place to invest. This is also not the case with the US. The economy is in a recession, the housing market is still dying, the credit crunch ongoing and the consumer is pulling back from spending.

So -- the two primary fundamental reasons for an increase in the dollar aren't occurring. Then why is it rallying?

Well -- the dollar isn't rallying. Instead, other currencies are falling because there is fresh evidence the "decoupling" of the world economies isn't happening. Instead, the US slowdown is slowing down everyone else:

The global economy -- which had long remained resilient despite U.S. weakness -- is now slowing significantly, with Europe offering the latest evidence of trouble.

On Thursday, the European Union's statistics agency said gross domestic product in the euro zone contracted 0.2% in the second quarter, the equivalent of a 0.8% annual rate of decline. It marked the first time since the early 1990s that GDP has fallen overall in the 15 countries that use the euro.

.....

With the European growth report, four of the world's five biggest economies -- the U.S., the euro zone, Japan and the U.K. -- are now flirting with recession.

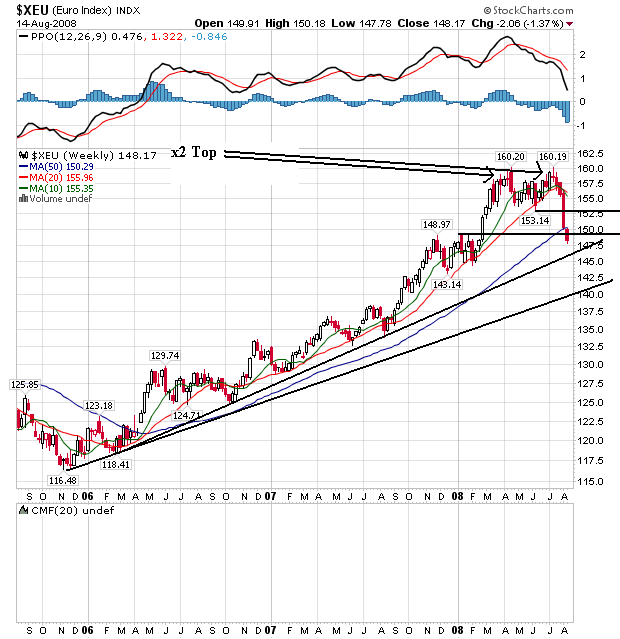

As a result, the euro is dropping:

First, notice the euro is more or less the exact mirror image of the dollar's chart for the last few years. That's because the euro has been the primary beneficiary of the dropping dollar as investors have moved some of their holdings into euros. However, also notice the recent change in the euro's chart as prices formed a double top with the first top occurring at the beginning of 2Q 2008 and the second top occurring at the beginning of 3Q 2008. Also note that prices have moved below all the weeks SMAs -- a bearish orientation. Finally, notice that prices are now below the 50 week SMA -- the first time they have been in this position for the last two years.

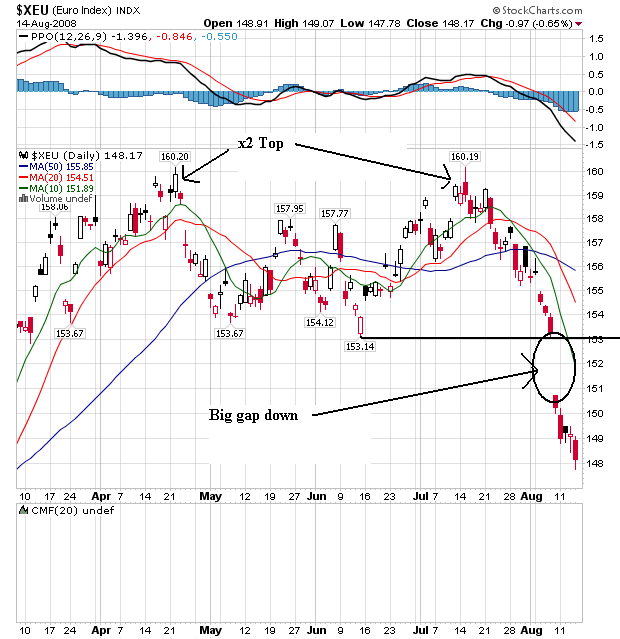

The daily chart of the euro shows important points in more detail.

-- The double top formation, and

-- A big downward move that started with a massive gap down.

-- The 10 and 20 day SMA are moving lower

-- The 10 and 20 day SMA have moved through the 50 day SMA

-- All the SMAs are moving lower

-- Prices are below all the SMAs

So -- we have a dropping euro that is benefiting the dollar. The euro is dropping because the EU zone is in a borderline recession right now -- as is the US. In other words, the overall pain is spreading.

No comments:

Post a Comment