Crude oil reached a record $100 a barrel and gold soared to the highest ever, leading a commodity surge as the dollar's slump against major currencies enhanced the appeal of raw materials as hedges against inflation.

Spot gold climbed to $860.10 an ounce, and wheat and soybeans jumped more than 3 percent. The UBS Bloomberg Constant Maturity Commodity Index gained as much as 2.2 percent today after climbing 22 percent in 2007. The dollar fell on speculation the Federal Reserve will cut borrowing costs in an attempt to bolster the U.S. economy.

``The most salient buzzword in 2008 is going to be inflation,'' said Michael Pento, senior market strategist for Delta Global Advisors Inc. in Huntington Beach, California, which manages about $1.4 billion. ``The Fed is lowering interest rates and vastly increasing the money supply. They're further fueling inflationary expectations.''

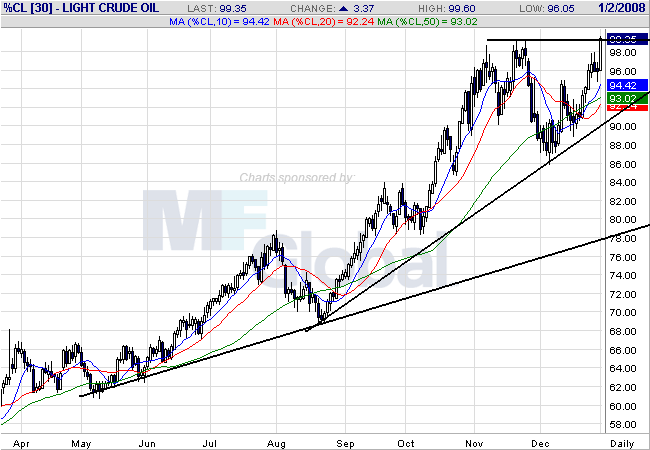

Here's the chart, via Futuresource:

Notice oil had been in a rally for the last year. Today's move breaks through technical resistance. If oil closes above $100/BBL, we'll officially be in new territory -- there is no technical resistance keeping prices from moving higher.

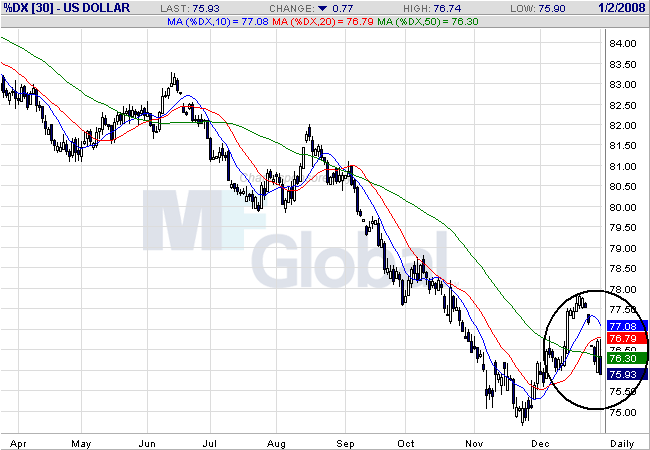

Here's a chart of the dollar:

Because oil is priced in dollars, a decrease in the dollar's value is a de facto price increase in oil. Notice the dollar dropped hard a few days ago. A gap is an indication of a meaningful change in sentiment. Notice the dollar gapped down after a decent rally.

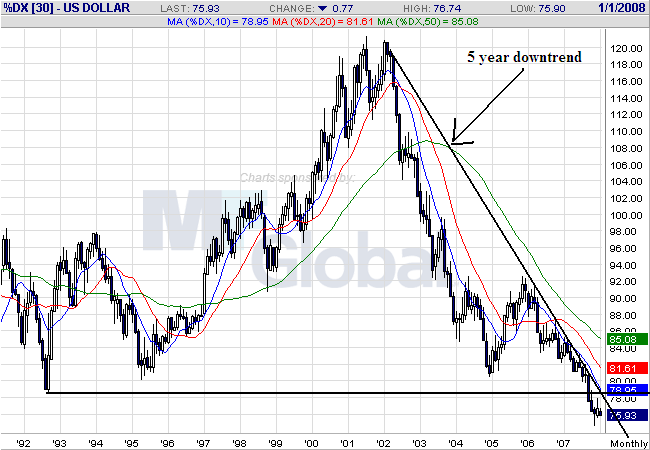

And here is a long term chart of the dollar:

That shows it's clearly in a major downtrend.

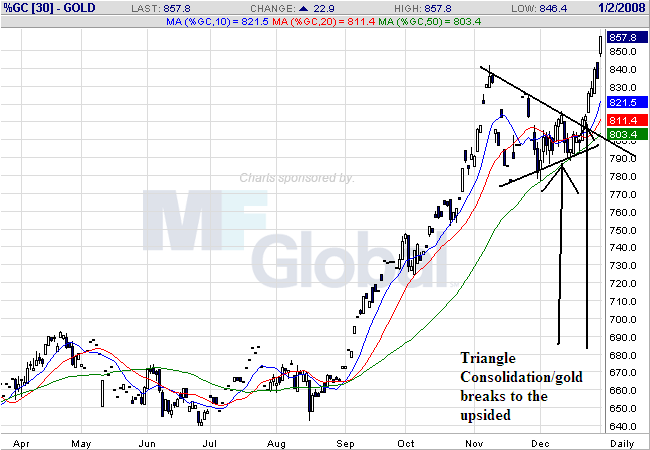

And gold is spiking:

Gold consolidated in November and December and has since broken out -- an indication that inflation expectations are increasing.

And here's a long term chart of gold:

Which shows it's really breaking out in a big way.

No comments:

Post a Comment