Disclaimer: I am not endorsing or dissing any of these issues. I am simply using the IBD list as a way to get a feel for what some traders are seeing in the markets.

There are two possible long-term trend lines with BIDU. But whichever one you like or prefer, the stock broken long-term support. In addition, the stock has fallen considerably below the 50 day SMA, and the 10 and 20 day SMA are both headed lower. This is starting to look like its moving into correction mode.

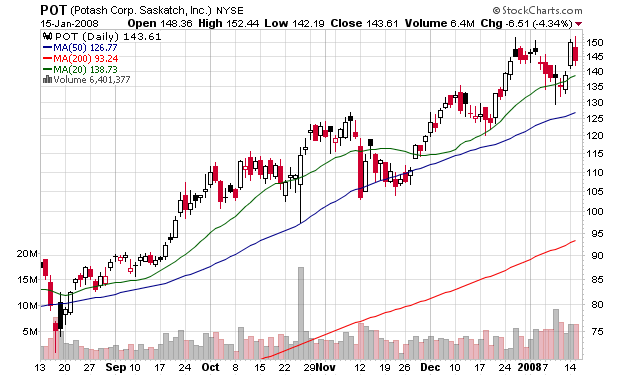

POT is still in a clear uptrend. It's been bouncing off the 20 and 50 day SMA for the last 6 months. The Agricultural chemicals are of the market is very strong and will probably remain so for some time.

STP (Suntech) has been hit by profit taking and is clearly in correction mode. The 10 and 20 day SMAs are both headed lower and prices have moved below the 50 day SMA.

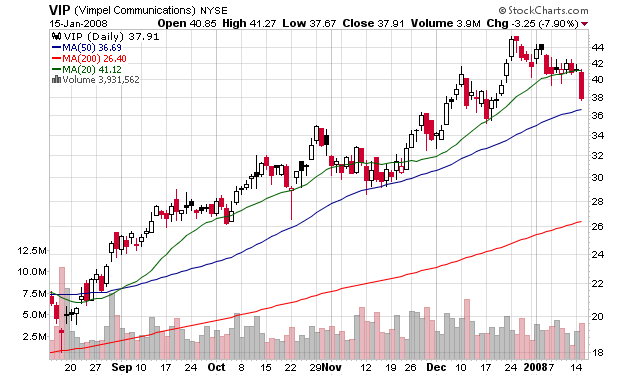

VIP (Vimpel Communications) is still in an uptrend as well. It has been bouncing off the 20 and 50 day SMA for the last 6 months. However, a few more days like yesterday and this stock will be in a correction/sell-off. But before we make a firm trend reversal call, the stock should move through the 50 day SMA.

China Medical is still rallying. The 10, 20 and 50 day SMAs are all moving higher, the shorter SMAs are higher than the longer SMAs and prices are above all the moving averages. It is a Chinese stock, after all.

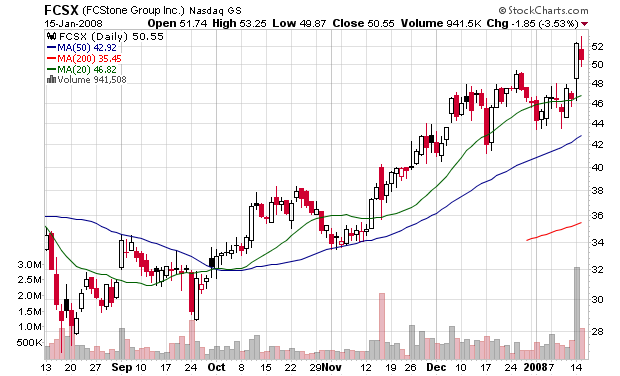

FC Stone (FCSX) is still clearly in a rally as well. It has been using the 20 and 50 day SMAs for support for the last few months. In addition, prices consolidated over the last month and broke out of that range on strong volume yesterday.

Apple is still in a rally, but is barely hanging on. Prices are below the 50 day SMA, the 10 and 20 day SMA have both turned lower and the 10 day SMA just crossed over the 50 day SMA at a fairly steep angle.

MDR (McDermott International) has formed two double tops. The first occurred in October of last year and the second occurred in October of last year and early January. In addition, prices are below the 50 day SMA, although they have been at this level before and rallied back. However, it looks like this stock is in the middle of a correction.

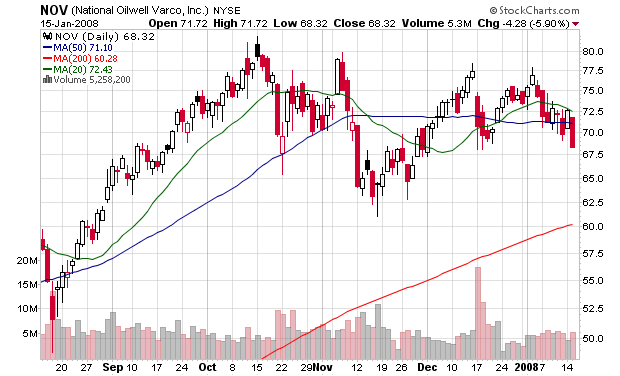

National Oilwell (NOV) is consolidating. The good news here is it hasn't crashed, largely because of its energy orientation. But the moving averages are clustered indicating the stock is looking for direction.

CF Industries is still rallying as well. All the moving averages are moving higher, the shorter SMAs are above the longer SMAa and prices are above all the SMAs.

So, we have the following:

Six stocks -- POT, FCSX, Apple, VIP, CMED and CF are still rallying.

One stock -- National Oilwell -- is consolidating.

Three stocks -- BIDU, STP and MDR have started to correct.

I should also add that BIDU has barely started to correct and Apple and VIP are barely hanging on.

No comments:

Post a Comment