"We think $100 per barrel oil is on the horizon in 2008, perhaps in the Spring," said Brian Hicks, co-manager of the Global Resources Fund. "Our forecast sees an average oil price around $80-$85, up from about an average of $70 in 2007."

He's far from alone. About 54% of a Barclays survey of 150 commodity investors expect the average price of oil over the next five years to top $100 a barrel, with 27% responding that it would be $80-$100 a barrel and 16% expected $60-$80 a barrel.

This view is largely backed up by the Energy Information Administration, the official statistics center of the U.S., which just upped its oil price outlook to an average of $84.93 in 2008, from its earlier view of $80 a month earlier.

"Expectations that tight market conditions will persist into 2008 are keeping oil prices high," the EIA said in its latest short-term outlook. "Despite the OPEC decision ... to hold production quotas steady and downward revisions to projected consumption growth in 2008, the oil balance outlook remains characterized by rising consumption, modest growth in non-OPEC supply, fairly low surplus capacity, and continuing risks of supply disruptions in a number of major producing nations."

There is a theory out there called "peak oil" which states the world is already at its maximum capacity and from here on out it's downhill. I can't speak for or against the veracity of this argument because I'm not a geologist. However, if you want more information on it, check out the Oil Drum.

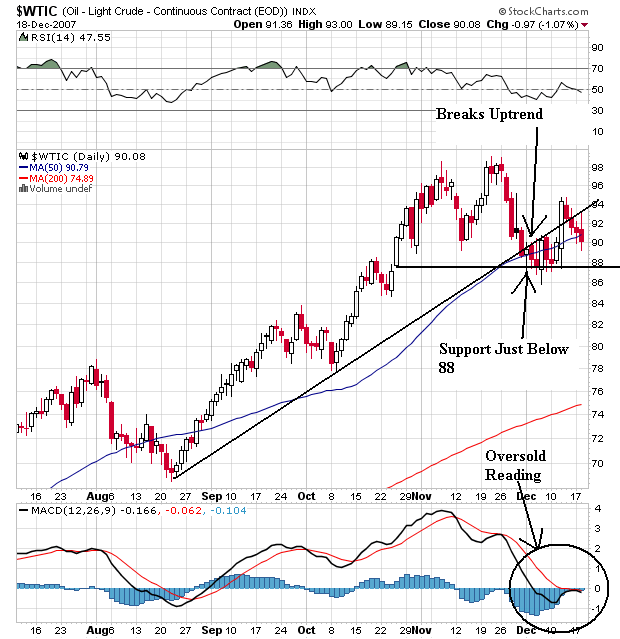

What I do know is the price chart says. Here is the daily chart.

Earlier this month, oil broke an uptrend that started in late August. But oil has also found support just below $88/bbl. The chart is consolidating right now, but the oversold reading on the MACD implies a stronger possibility of increasing prices ahead.

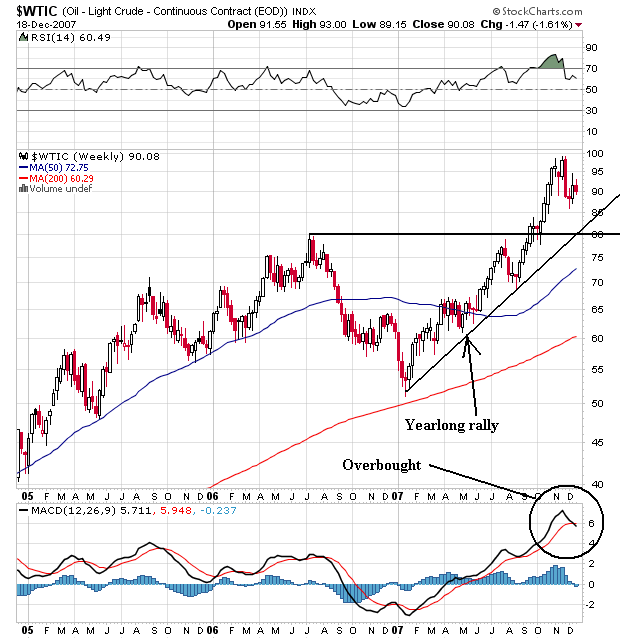

On the weekly chart, oil is in the middle of a strong, year-long rally. It has a clear pattern of higher highs and higher lows. It also broke through previous resistance established in mid-2006. The only thing holding this chart back is the overbought readings on the MACD.

Let me add a word of caution about technical indicators like RSI/MACD and the like. As a chart reader, I am really more a fan of a "pure" chart -- a chart with prices and moving averages. Technical readings on indicators like the MACD can stay at overbought/oversold levels for some time. This means they can give the wrong signal. In my opinion, the best way to read a chart is to simply look at the overall price trend with the help of simple moving averages and then be well aware of the fundamental picture behind the chart. For example, if a chart is "overbought" technically, there is probably a strong fundamental reason for it. The same is true for a stock that is "oversold". That's not to say you shouldn't be aware of the underlying technical indicators of the chart, just that the fundamental picture is also very important.

No comments:

Post a Comment