Foreclosure filings for November surged 68% from a year ago but dropped 10% from October, another sign that foreclosure activity overall may have peaked for the year, a foreclosure-listing service said.

RealtyTrac Inc. Chief Executive James J. Saccacio said that November's 10% drop from October was the first double-digit monthly decrease observed since April 2006.

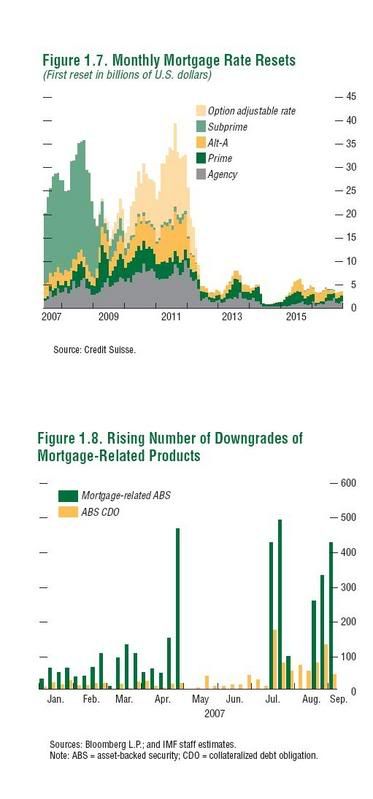

The sequential decline "could indicate that foreclosure activity has topped out for the year, but the true test of whether this ceiling will hold will come at the beginning of next year -- when we anticipate that a seasonal surge in foreclosure filings and another possible wave of resetting mortgages could place further pressure on the housing market," Mr. Saccacio said.

No -- foreclosures aren't going to decrease. Why can I say that with near certainty? Because we have a slew of resets next year.

There is no way we're going to see a decrease in foreclosures anytime soon.

But Bonddad! The Bush plan is in effect! That will save us!

No it won't. The most liberal estimate I have seen about the number of homeowners it would help is about 400,000. However, the most conservative estimate I have seen about foreclosures next year is 1.2 million. So, assuming the best outcome of the Bush plan and the best outcome on the foreclosure front, we're still looking at 800,000 foreclosures next year.

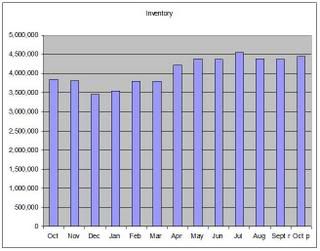

Now, let's add that information to the existing home inventory figures.

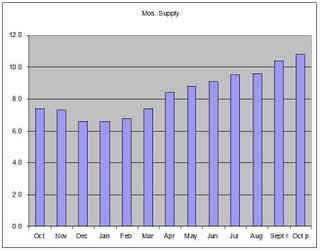

And the months of supply:

Short version: assuming the best of all the estimates, we're still looking at a world of hurt.

No comments:

Post a Comment