A combination of factors has helped to stabilize the dollar, though it remains quite weak. Some recent data have given comfort to those expecting the broader economy to escape the housing crisis with a slowdown in growth rather than an actual recession -- typically defined as two consecutive quarters of contraction. The Federal Reserve is taking new steps to tame the credit crisis. Countries in the Persian Gulf, which appeared on the brink of breaking their currency pegs to the U.S. dollar, have refrained from making any changes.

.....

One recent challenge to the gloomy view on the economy came Thursday, when data showed retail sales in November were more resilient than predicted. The figures suggested "we don't really have a freefall in the U.S. economy," says Adnan Akant, a currency specialist at money manager Fischer Francis Trees & Watts. "It's slowing down but not falling out of bed."

Then on Friday, government data showed inflation last month was stronger than expected. That generated a fresh wave of dollar buying, pushing the greenback up about 1.4% against the euro in a day. Since late November, when the dollar weakened to a record low versus the euro, it has strengthened about 3%. Still, the dollar remains 8.5% weaker against the euro since the start of the year. Late Friday in New York, one euro fetched $1.4423.

The retail sales figures for November were countered by two weeks of weak December sales, so I wouldn't go hanging my hat on those numbers.

However, the inflation story is far more important. Simply put, the Fed is now really hemmed in policy wise and may not be able to lower rates much more in the wake of the recent inflation numbers. And that could be dollar bullish -- or at least dollar neutral.

But, it's also important to remember the overall US economic picture isn't that solid. Corporate profits are weakening, job growth is fair but not great and housing problems aren't going away anytime soon.

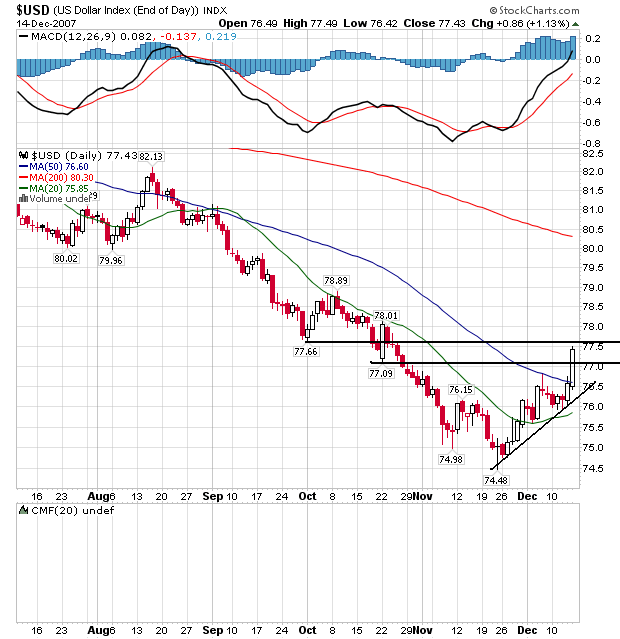

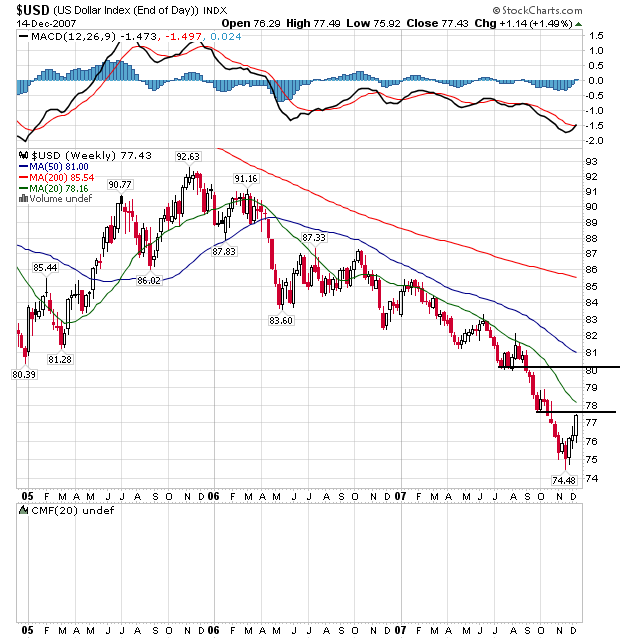

Let's go to the charts:

On the daily chart, notice the dollar has clearly rallied from it's late November lows. It moved through the 20 day SMA, consolidated in a triangle pattern and then rallied through the 50 day SMA. Both of these are technically significant events because the SMAs will now provide technical support in the event of a sell-off. In addition, the 20 day SMA has turned positive as well -- for the first time in a long time. This indicates the shorter term trend is moving positive as well. Plus, with prices now above this number, this SMA will now get pulled higher.

However, on the weekly chart we still have a pattern of lower lows and lower highs. The index is going to have to move through 80 before we can start to think about a trend reversal. This means that we could merely be looking at a standard bear market rally instead of a rebound.

No comments:

Post a Comment