Crude-oil prices leapt 3.6% to a new commodities-market high of more than $98 a barrel, adding to growing evidence that the cost could remain high for months and pose a challenge to the economies of many industrialized nations.

A survey of energy analysts by Dow Jones Newswires released yesterday found these observers believed oil prices would stay strong well into next year. They forecast that prices would simmer down only at the end of 2008, as the world's richest economies, including the U.S., begin to flag.

The weakening U.S. dollar, the currency used to buy and sell oil globally, is helping reinforce the notion that oil prices could remain high. The dollar fell against the euro yesterday after the Federal Open Market Committee released minutes from its most recent meeting. A weaker dollar blunts the effect of higher oil prices outside the U.S. and gives purchasers in other currencies greater power.

.....

Looking ahead, energy analysts see little to reverse current trends that have sent oil on its record trajectory this year. "Demand growth has been surprisingly strong, especially in the emerging markets, supply hasn't really responded, and the weaker [U.S.] dollar has driven up prices because of strong demand in the U.K. and Europe," said Royal Bank of Scotland Group PLC senior economic adviser Thorsten Fischer.

.....

But oil markets are still bedeviled by longer-term trends: growing demand from the developing world, continued supply constraints and political uncertainties in major oil-producing regions like the Middle East. "Despite apparent weakness in the U.S. economy, the global economy is going ahead. China and India continue to march forward and demand oil and OPEC isn't supplying much more," says Chris Ross, a vice president at consulting firm CRA International Inc. While oil prices can turn quickly, he said, "my belief is the balance of probabilities is towards strength rather than weakness."

Let's tie a couple a large themes together.

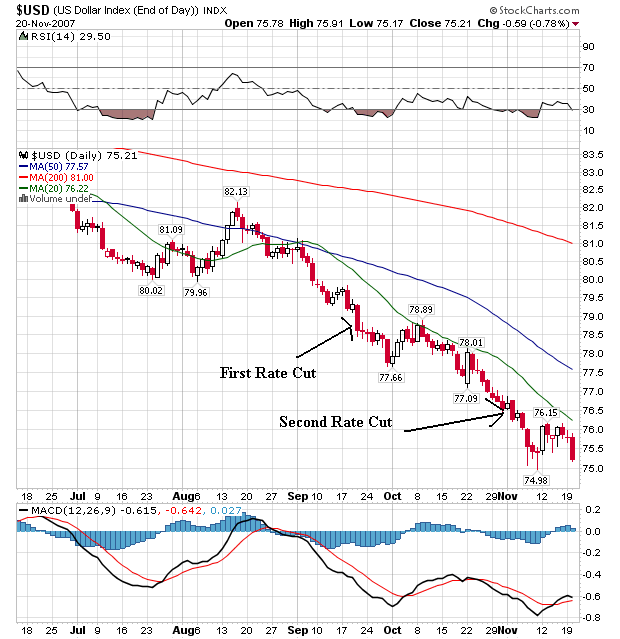

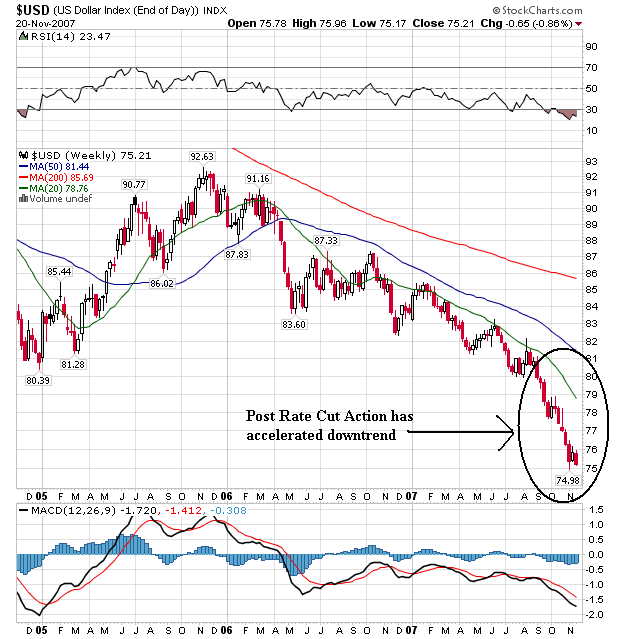

1.) One of the reasons I argued against the Fed's rate cut was a cut would hammer the dollar. As this chart below shows, the dollar has dropped about 4.4% (approximately) since the Fed cut interest rates.

The Fed's cuts merely accelerated a downward trend in the dollar that has been in place for the last two years. Note on the following weekly chart that the dollar's descent was orderly until the Fed started cutting rates. Since then the dollar's downward move has been much faster.

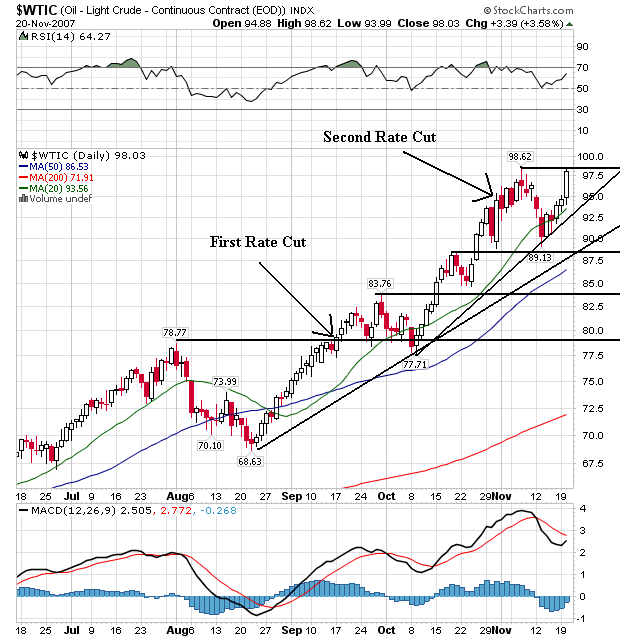

Now let's turn to oil's chart.

Notice the following.

1.) This is a bull market chart. Prices are making higher highs and higher lows. In addition, prices are moving beyond previously established highs. All of the simple moving averages (SMAs) are moving higher. Prices are above the SMAs. This chart says "find a buy point, NOW."

2.) Notice that oil has risen about 25% since the Fed started cutting rates. As the dollar has decreased oil has increased as a hedge against the dollar's devaluation. In addition, the dollar's drop has in and of itself devalued oil because oil is priced in dollars.

So, as the dollar has dropped traders have purchased oil as an inflation hedge. As a result, gasoline prices at the pump at a lot higher now than they were at the same time last year -- and they're increasing:

I couldn't end this post without harping on the continual statements from the US that "we have a strong dollar policy." Please stop it. You're doing nothing but making asses out of yourselves with these statements. If this is what a strong dollar policy looks like, I'd hate to see what a weak dollar policy looks like.

No comments:

Post a Comment