The property value of U.S. homes will fall by $1.2 trillion, and "at least" 1.4 million homeowners will lose their properties to foreclosure in 2008, according to a study released Tuesday by the U.S. Conference of Mayors and the Council for the New American City.

The study, prepared by forecasting firm Global Insight Inc., predicts a widespread and deep economic impact from ongoing housing market problems, which many expect to stretch through next year.

.....

There have already been a record number of homeowners entering the foreclosure process this year, and many have warned the problems will continue through 2008. One major reason for this is subprime adjustable-rate mortgages, many of which began with low teaser rates but grow into much higher monthly requirements after several years. A high concentration of these loans are expected to become more expensive next year, and both the banking industry and government leaders are trying to find ways to address it.

The phrase "record number of foreclosures" should catch everyone's attention in a big way. As the housing crisis has progressed there have been a few people trying to predict a bottom along the way. Of course, the market has made fools of these people.

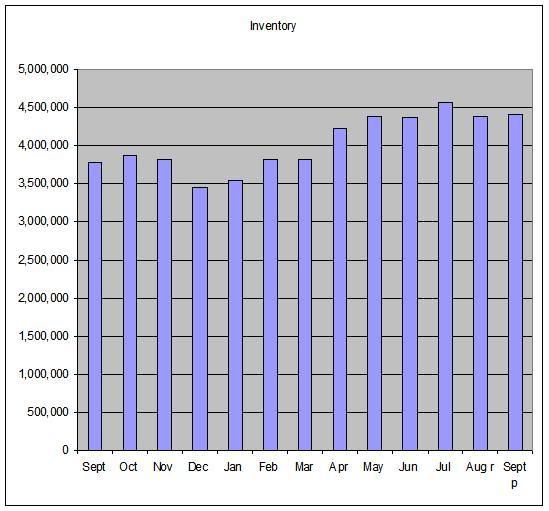

Inventory is the first real estate number that caught my eye and it continues to cause me great concern. Here is a chart of total inventory available for sale from the National Association of Realtors:

At the current sales pace, that's a 10.5 month supply of homes on the market. That's a glut no matter how you slice it. Also notice that over the last year we haven't seen any meaningful decrease in the inventory available for sale. That means the current sales pace is insufficient to dent this number. In other words, either a lot more buyers will have to emerge and/or sellers will have to start to really lower their prices. Considering lenders are tightening their standards, it seems far more likely that sellers will have to lower their prices.

Now we have a report that:

1.) Foreclosures are already at an all-time high, and

2.) We're going to have more foreclosures.

I've been trying to find an economic word for the amount of inventory that is higher than the word "glut" and can't think of it. I guess "super-glut" will have to do.

There is no reason to think lending standards will loosen anytime soon. Lenders are already bleeding from their lax lending policies.

That means this super-glut of inventory will be the standard for the foreseeable future. With decreased demand from tightening lending standards, the only way for the market to arrive at a market clearing price level is lower prices.

No comments:

Post a Comment