The combined value of two leading sources of credit — outstanding commercial and industrial bank loans, and short-term loans known as commercial paper — peaked at about $3.3 trillion in August, according to data from the Federal Reserve. By mid-November, such credit was down to $3 trillion, a drop of nearly 9 percent.

Not once in the years since the Fed began tracking such numbers in 1973 has this artery of finance constricted so rapidly. Smaller declines preceded three recessions going back to 1975; at other times such declines tended to occur in conjunction with an economic downturn.

Policy makers at the Federal Reserve are growing increasingly alarmed about the problem, which is an outgrowth of the woes of the housing and mortgage industries. Just yesterday, the Fed’s vice chairman, Donald L. Kohn, said that the latest market turbulence appeared to be reducing credit to businesses and consumers, hinting that the central bank, in response, was prepared to cut interest rates further.

From Bloomberg:

``The credit crunch began in earnest back in July, but what you're seeing now is it's deepening and spreading out,'' said Kathleen Bostjancic, an economist in New York at Merrill Lynch & Co., which expects the Fed's target lending rate to fall to 2 percent by the end of the second quarter of 2009. ``You're seeing a tremendous flight to quality.''

.....

``Certainly it feels a lot like the Long-Term Capital Management crisis,'' said Vincent Boberski, senior vice president of portfolio strategies in Chicago at FTN Financial.

When people in the financial markets start to compare recent events to another financial disaster you know things are bad.

This is a huge problem and it isn't going away anytime soon. It is also the primary reason why more rate cuts won't do any good. The problem is not about money. It's about confidence. It seems like everyday we hear from a financial company that is writing down a portfolio, or has massive losses in mortgage related products or something similar. The issue is confidence -- as in, "will this borrower be able to pay me back in even a short period of time?" More and more the answer is coming back "no," so loans are drying up.

This highlights the bigger issue, which is the impact of spreading risk out far and wide. While I am all for structures that spread risk out, I am not all for -- and in fact am completely against -- the terrible underwriting standards the lending industry had for about two years. Basically lenders would check to see if a borrower had a pulse. If he was alive, he got a loan (and frankly, I think the pulse was optional with some lenders). Lenders were confident they could spread this risk out far enough so that it wouldn't have an impact.

Well -- now we know better. And as a result credit -- which is the lifeblood of the modern economy -- is tightening right before out very eyes.

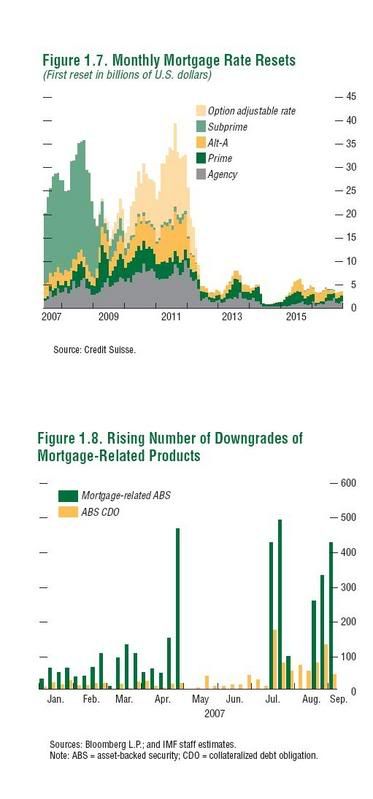

And the problem is this is just getting started. Below is a chart from the IMF with data from Credit Suisse. I've pulled this chart out half a million times since it came out, and I will continue to do so. It shows very clearly that we have another 3-4 years of mortgage resets coming. And the sheer amount of those rests is huge. Notice that in 2010 and 2011 we have similar monthly totals of resets that we had this year. And this year has sucked royally.

This chart is one of the main reasons I have been sharply critical of anyone advising people to buy financial companies. I think that advice is reckless beyond belief considering the implications of the above chart.

As a result of all of this, we've seen a huge flight to quality. That means Treasury bonds are rallying.

1-3 year Treasury ETF

7-10 year Treasury ETF

20+ year Treasury ETF

So long as the uncertainly about the credit markets is out there I doubt we'll see a sell-off in the bond market.

No comments:

Post a Comment