After a bailout of Fannie Mae and Freddie Mac, $168-billion of fiscal stimulus measures, a housing-rescue package and three-and-a-quarter percentage points worth of Federal Reserve interest rate cuts, the economy is still struggling and in some ways looks worse than ever.

And while the recent one-two punch of rising joblessness and shrinking payrolls restarted the recession debate, it begs an even bigger question: What will it take to bring the economy back to health, especially in a presidential election year?

Let's back up a bit and rundown everything that has been done to keep the economy going.

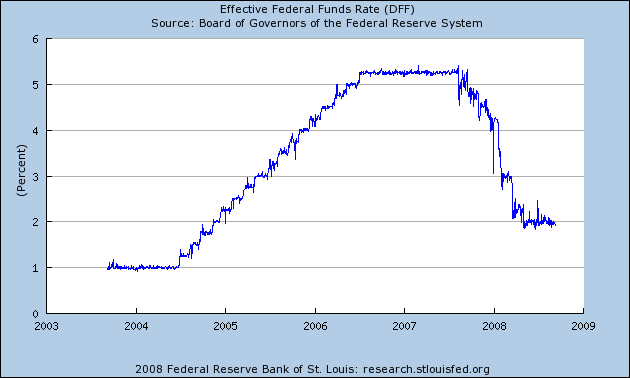

1.) We have a Federal Reserve that has cut interest rates to 0% after adjusting for inflation. Here's a chart from the St. Louis Federal Reserve of the effective federal funds rate:

So -- money is cheap. That means we should be seeing lots of lending, right?

Well, no. According to Bloomberg 1-month Libor is still 50 basis points above the effective Fed Funds rate. That means there isn't as much intra-bank lending going on as we would like. That means we are still seeing institutions horde cash.

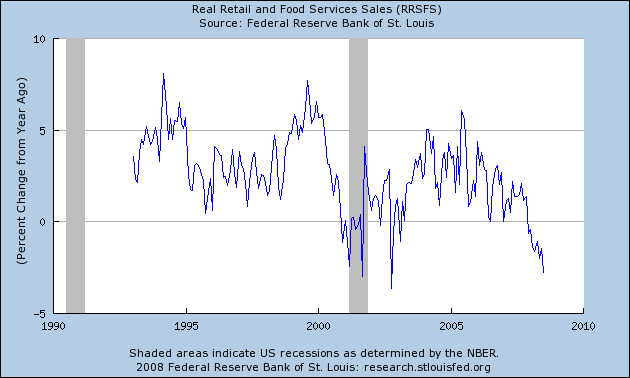

2.) We've seen the federal government give away money to increase spending. Did that work?

Year-over-year real (inflation-adjusted) retail sales are now negative, and

Year-over-year personal consumption expenditures are still positive but have been dropping for a year.

So people are tightening their belts -- and have been for awhile.

All that has really happened is the US is increasing its budget deficit:

The Congressional Budget Office said the U.S. budget deficit for fiscal 2008 -- $407 billion -- will be more than double the deficit for 2007, hit by the wars and a weak economy, and predicted it is likely to rise further in fiscal 2009.

"The figures make it challenging to avoid playing the dismal economist," said CBO director Peter Orszag in a statement.

The agency foresees an increase to $438 billion by fiscal 2009, which begins Oct. 1, with the government takeover of Fannie Mae and Freddie Mac further complicating budget projections.

The bottom line is we've done pretty much everything we possibly can at this point and we're nowhere near out of the woods. And that is what should scare people the most.

No comments:

Post a Comment