Then I wake up and find out Lehman and Merrill Lynch are no longer going concerns on Wall Street. And this is a few weeks after the "free market" US nationalizes it's mortgage industry.

Let's back up a bit and see how we got here. Advance warning: this will be long and fairly complicated, so get a cup of coffee now (actually, get the pot ready).

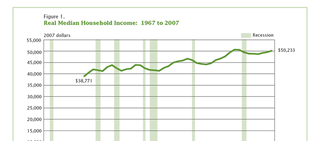

A few weeks ago, I wrote an article titled, "An extended shallow near recession." This was a riff off a comment made by one of the people who writes at Angry Bear. The point is this expansion has not felt like a real expansion. Job growth has been the weakest of any expansion since 1960. Real median household income is now at the same level it was in 2001. (Please see The Bush Boom Was A Complete Bust.) Combined these elements tell us the economy is doing very poorly. These two points also tell us there is at least one fundamental problem with the economy if not more.

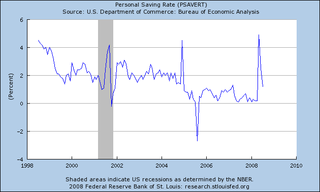

So -- let's look at am important fundamental issue with the US economy. At the beginning of this expansion the US savings rate was right around 2%. Here's a graph from the St. Louis Federal Reserve:

Here's what this figure means. An economist defines savings as all the money left over after a person spends money on everything else. In other words, after a person has paid their bills and mortgage and bought all their other stuff (clothes, restaurants etc...) the left over money is "savings". The assumption here is people buy stuff and then save whatever is left. The point with this data is at the beginning of this expansion people were already spending just about everything they made.

Let's add in two more data points. Personal consumption expenditures increased for the duration of this expansion. According to the Bureau of Economic Analysis, real personal consumption expenditures increased from a level of 104.128 to 123.931. So people kept spending. At the same time, incomes have been stagnant for the vast majority of the US population.

Workers with professional degrees, such as doctors and lawyers, were the only educational group to see their inflation-adjusted earnings increase over the most recent economic expansion, adding to the concern that the economy has benefited higher-earning Americans at the expense of others.

Workers in every other educational group -- including Ph.D.s as well as high school dropouts -- earned less in 2007 than they did in 2000, adjusted for inflation, according to data from the Census Bureau. Data don't include 2008 earnings.

This same data is born out in the Census Bureau's real median household income:

So let's sum up. Real (inflation adjusted) incomes for the vast majority of Americans declined this expansion. At the same time, people were already spending most of their incomes at the beginning of this expansion yet they continued to increased their spending for the duration of this expansion. Where did all of the new money for increased spending come from?

Tons of debt. At the beginning of this expansion total household debt outstanding stood at $7.6 trillion. That current figure is $13.9 trillion. That's an increase of 82%. To place that figure in perspective, total household debt outstanding is now almost as large as total US GDP. All of that does not exist in a vacuum; it has to go somewhere. And that's where we get to the current problems in the markets.

As the figures above shows, the US went on a debt orgy primarily concentrated in mortgages. First, the Federal Reserve lowered interest rates to 0% after adjusting for inflation. Then the financial system had to increase the number of people who could access the debt market and increase the amount of money they could get access too. However early on it was obvious this would cause problems:

Edward M. Gramlich, a Federal Reserve governor who died in September, warned nearly seven years ago that a fast-growing new breed of lenders was luring many people into risky mortgages they could not afford.

But when Mr. Gramlich privately urged Fed examiners to investigate mortgage lenders affiliated with national banks, he was rebuffed by Alan Greenspan, the Fed chairman.

In 2001, a senior Treasury official, Sheila C. Bair, tried to persuade subprime lenders to adopt a code of "best practices" and to let outside monitors verify their compliance. None of the lenders would agree to the monitors, and many rejected the code itself. Even those who did adopt those practices, Ms. Bair recalled recently, soon let them slip.

And leaders of a housing advocacy group in California, meeting with Mr. Greenspan in 2004, warned that deception was increasing and unscrupulous practices were spreading.

John C. Gamboa and Robert L. Gnaizda of the Greenlining Institute implored Mr. Greenspan to use his bully pulpit and press for a voluntary code of conduct.

"He never gave us a good reason, but he didn't want to do it," Mr. Gnaizda said last week. "He just wasn't interested."

All of this debt was cut into a large amount of securitized debt -- collateralized mortgage obligations (CMOs), collateralized debt obligations and the like. The belief among everybody was securitization so spread out risk that possible problems (like the ones we are currently having) were non-existent.

All of this debt was based on the housing sector, which was grossly inflated from the overly aggressive federal reserve. All of this debt was purchased by, well, everyone. And that's what's leading to all of the problems on Wall Street. As housing collapses we are learning the following:

1.) Record low interest rates increase borrowing. This is standard economics. Lower the cost of most goods and demand will increase.

2.) Housing was clearly in a bubble.

3.) Increasing the number of people who have access to debt and the amount of money they can borrow is not the greatest idea.

4.) Securitization -- while a solid financial development -- does not so spread out risk that risk is eliminated.

As the value of housing has dropped, the number of people who have defaulted on their loans has increased. This means the collateral backing all of these securitzed loans has deteriorated. This means that all of the CMOs, CLOS and the like that everyone has purchased are no longer worth anywhere near what everybody thought they were worth. As a result, you are seeing tons of "writedowns" all over Wall Street. This simply means firms are saying "this bond isn't worth $100, it's worth $90." The problem is everybody is writing down debt. So far we've had over $550 billion in writedowns. And these writedowns are what is leading to events like those we are having today. And there is no reason to think we are anywhere near done with these problems.

So, let's sum up all the points made above.

1.) Incomes shrank for most Americans over the last expansion.

2.) But Americans kept spending thanks to a mammoth increase in household debt.

3.) To increase the amount of debt in the system, lending standards were lowered.

4.) Lowered lending standards have led to a higher default rate from borrowers.

5.) Higher default rates have lowered the value of all the collateral backed by mortgages.

6.) Lowered collateral values have killed the balance sheets of literally every major financial company.

No comments:

Post a Comment