Morgan Stanley is planning another round of layoffs in the coming days, finalizing a plan to slash another 5 percent from its securities-firm workforce, or 1,500 employees, CNBC has learned. And Lehman will announce another round of cuts in addition to those already begun as early as next week.

.....

JPMorgan is expected to cut more than half of Bear Stearns' 14,000 former employees, though CNBC has learned that JPMorgan has already offered jobs to around 4,000 former Bear workers. Senior people inside JPMorgan say the firm has no hard figure for the size of the layoffs.

Meanwhile, CNBC has learned that Lehman Brothers Holdings Inc next week also is expected to add to the 4,900 layoffs it has already announced.

And on the front page of today's WSJ:

UBS AG said Tuesday it would sell $15 billion in mortgage assets to BlackRock Inc. and slash 5,500 jobs by the middle of next year, moves meant to restructure the Swiss giant's troubled investment bank.

The Zurich-based bank will sell $15 billion -- with a nominal value of $22 billion -- in Alt-A and subprime assets to Blackrock, which will manage the holdings in a fund for distressed securities. Alt-A assets are considered slightly less risky than subprime loans.

The Zurich bank said it will ax 2,600 investment banking jobs, mainly in London and New York, after write-downs on dud mortgage securities totaling more than $37 billion. The remainder of the jobs will be cut through natural attrition across the bank's units, UBS said.

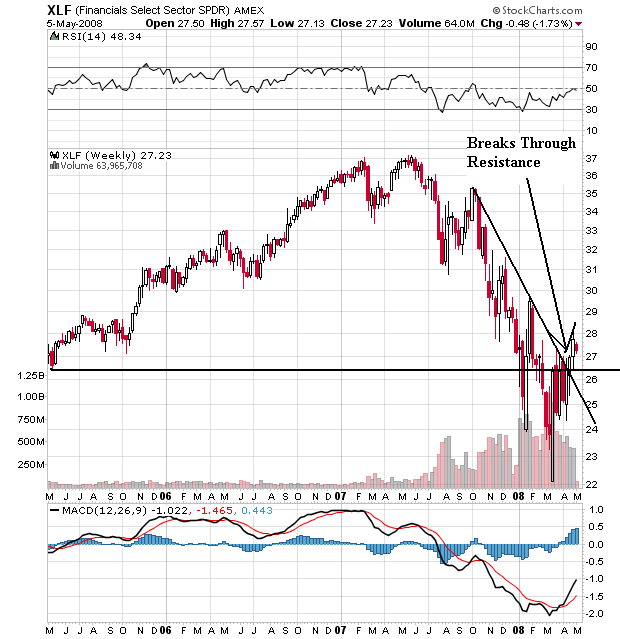

Let's take a look at the XLFs to see how they're doing.

Let's start with the weekly chart, because it shows an important reversal. Starting at the end of last summer, the financials sold-off big -- as in losing over 10 points. That's a big move. But take a look at the volume levels -- those indicate the market may have had a selling climax.

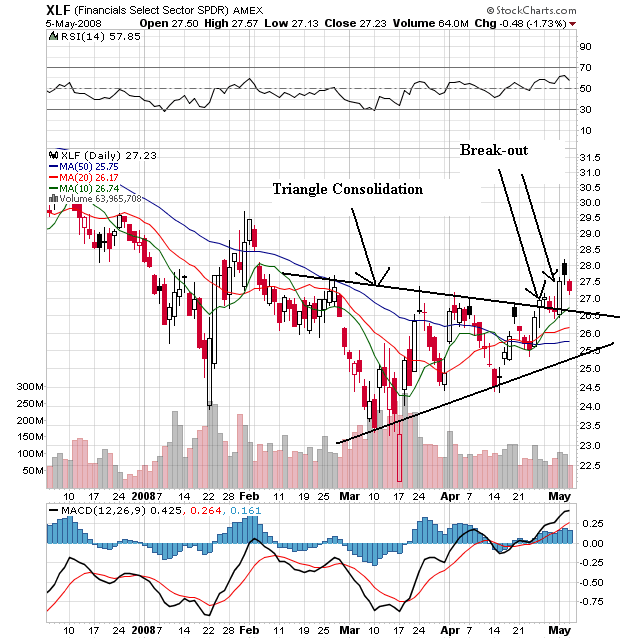

On the daily chart, notice the following:

-- Prices are rising from a triangle pattern. They broke through on decent volume.

-- Prices are above the SMAs

-- The shorter SMAs are higher than the longer SMAs

-- The 10 and 20 SMAs are rising.

Given the above lay-off news and the overall credit market situation, I can't see this rally being that strong. However, traders may be betting that the worst is actually over. I don't see it, but I've been wrong before.

No comments:

Post a Comment