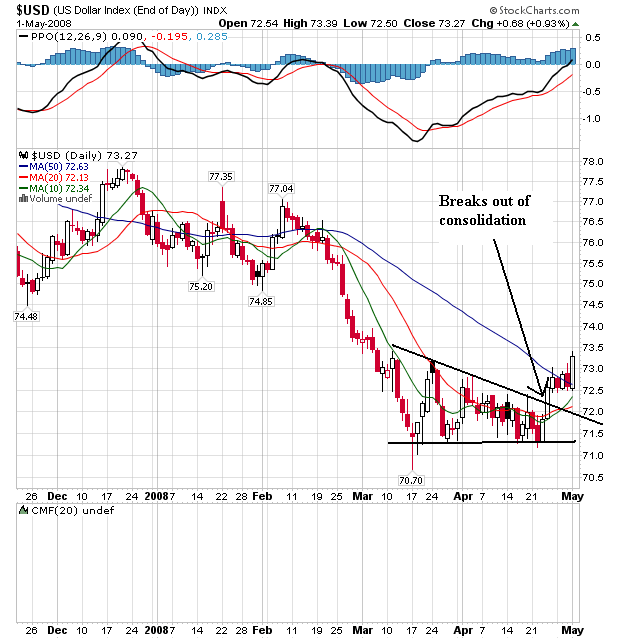

The dollar has broken out of a triangle consolidation pattern and rallied. Notice prices are above the SMAs which will pull them higher. Also note the 10 day SMA just crossed over the 20 day SMA which is a bullish crossover.

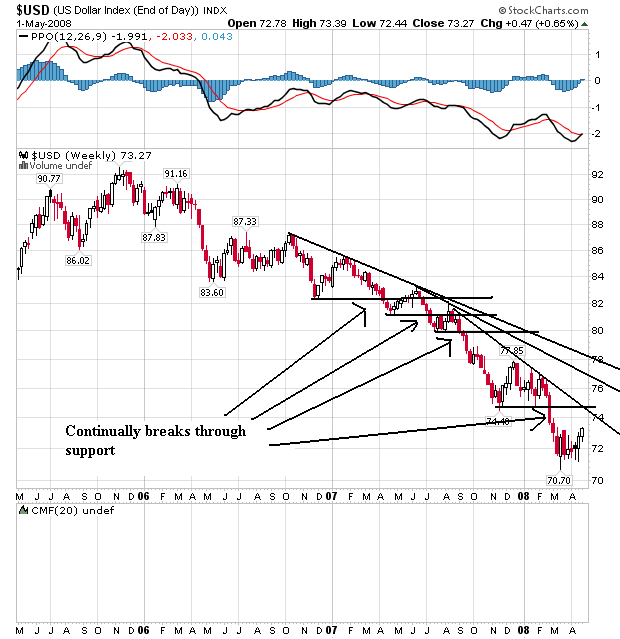

However, the dollar is still at the bottom of a long downward trek. Before we get too excited about the rally, let's remember the longer term context.

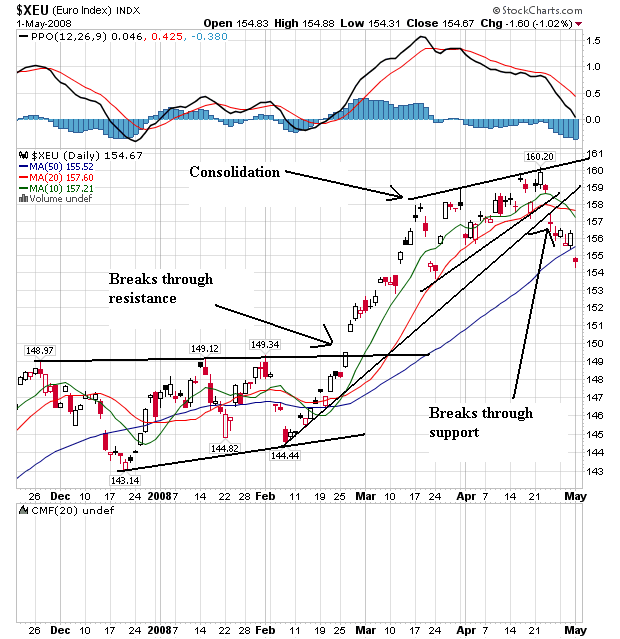

The euro broke out of a triangle consolidation pattern late February and rallied for two months. The euro formed another triangle/pennant consolidation pattern in mid-March and has since fallen through support. Prices have fallen through the 50 day SMA which is a bearish signal.

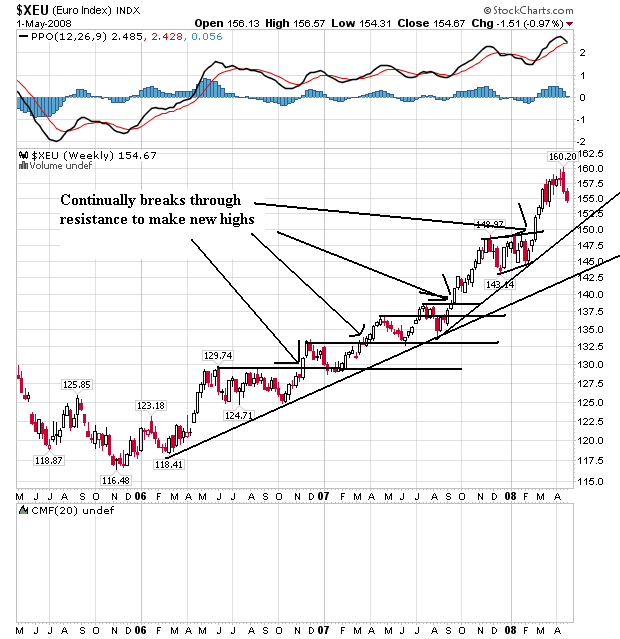

However on the long-term chart, notice the euro is still in the middle of a rally.

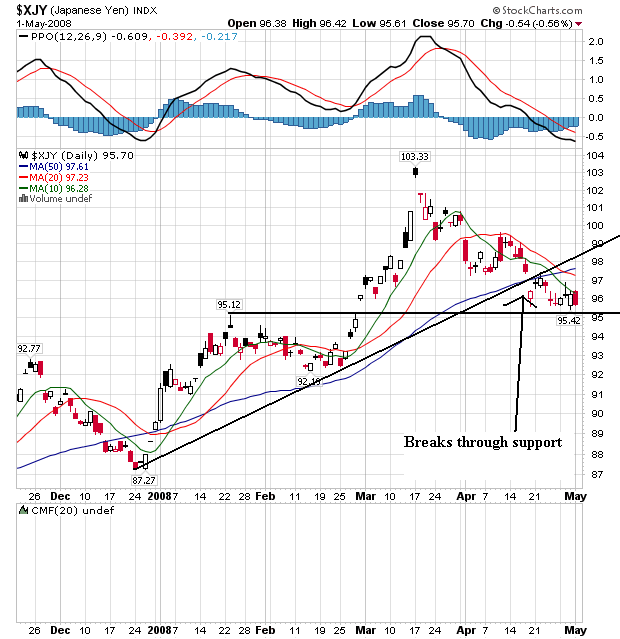

The yen had been rallying since late December. However, it has fallen through support from that rally. Also note the 10 and 20 day SMA have fallen through the 50 day SMA, a bearish signal. Finally, notice that prices are below all the shorter SMAs, which is also bearish.

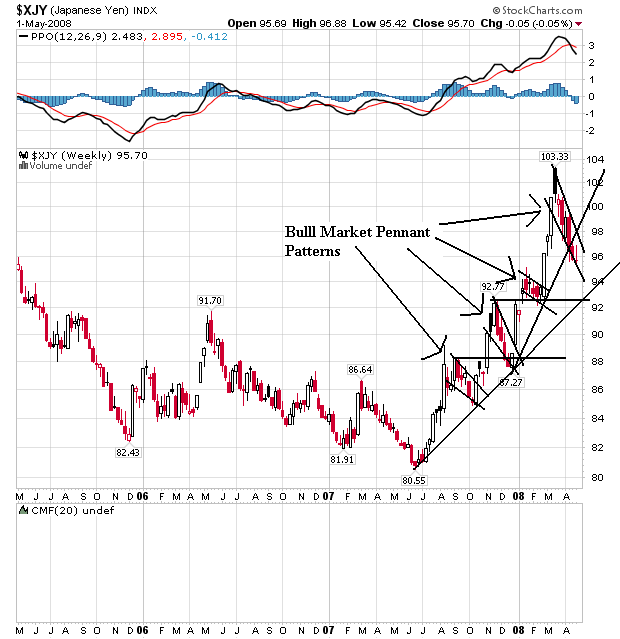

Since mid-summer the yen has rallied. However, also notice

Here's the central story to the forex markets for the last week or so:

The dollar has been weighed down recently by a combination of gloomy U.S. economic data and high European inflation.

Bad economic news in the US depresses the dollar because bad economic news makes the US economy a less attractive place for foreigners to invest. At the same time, high inflation news from Europe has led the European Central Bank (ECB) to keep rates unchanged. Therefore, the difference between US and European interest rates remains high. This makes the euro attractive as an investment, leading to its recent gains.

On Thursday, we learned that European business confidence is dropping as the result of inflationary pressures:

Business confidence in Germany and France, which account for about half the euro-region economy, slumped in April as record oil and food prices stoked inflation.

The Munich-based Ifo institute said its business climate index, based on a survey of 7,000 executives, fell to 102.4 from 104.8 in March. That's the lowest since January 2006. In France, sentiment among 4,000 manufacturers slid to a 16-month low of 106 from 108, Insee, the Paris-based national statistics office said.

Inflation in the 15 euro nations jumped to a 16-year high of 3.6 percent in March, crimping the purchasing power of companies and consumers. With the euro's 9 percent gain against the dollar this year threatening exports and the U.S. housing recession pushing up credit costs worldwide, the International Monetary Fund this month cut its growth forecast for Europe.

``Everything is worrying for executives: raw material prices climbing almost uncontrollably, the euro's rise, the global slowdown that's shaping up,'' said Bruno Cavalier, an economist with Oddo & Cie. in Paris. ``There's every reason for growth to deteriorate.'

One of the main reasons the euro has done so wel versus the dollar is the interest rate differential. So long as interest rates the in euro area are higher than the US the euro should have a trading floor. And there is every indication European interest rates will remain high:

Food-price inflation in Europe accelerated to 6.2 percent in March from 5.8 percent in the previous month. That's the highest since the European Union's statistics office, Eurostat, began the current data series in 1997. The prices for rice, soybeans, wheat and corn have all risen to records this year.

Crude oil reached a record of $119.90 a barrel on April 22.

Policy makers including Germany's Axel Weber and Juergen Stark have suggested the ECB's current benchmark rate of 4 percent may not be high enough to combat inflation.

In other words -- interest rates might not be high enough. That means the ECB is taking their role in promoting price stability far more seriously than the Federal Reserve.

The previous Wednesday, there were more hawkish statements from the ECB

The euro's push through $1.60 Tuesday was propelled in part by remarks by ECB council member and Bank of France Gov. Christian Noyer, who told French radio that the ECB would take any "necessary" steps to bring inflation back down to its 2% target by 2009. Consumer inflation in the euro-zone was pegged at an annual rate of 3.6% in March.

"If needed, we will move interest rates," Noyer said.

But Noyer told the Wall Street Journal Europe that his comments were over-interpreted by the markets.

"Movements can go both ways," he said. "I would never engage in a discussion about the future path of interest rates, simply because nobody knows."

On Monday, the European Central bank reiterated its stance that price stability is their most important objective:

European Central Bank President Jean-Claude Trichet reiterated yesterday that he's concerned about a surge in the euro against the dollar, according to an interview with the Austrian state broadcaster. He added that the ECB's ``responsibility'' is to ``preserve price stability in the medium and long term.''

ECB policy makers have held the main refinancing rate at a six-year high of 4 percent since June to contain inflation. The U.S. central bank has cut the fed funds target by 3 percentage points to 2.25 percent since September to prevent banks' reluctance to lend from plunging the economy into a recession.

But the euro area will be under increased pressure to drop interest rates as retail sales showed a sharp decline:

The measure of sales growth in the euro region declined for a second month to a seasonally adjusted 41.8 from 48.2 in March. A reading below 50 indicates contraction. The index, which is based on a survey of more than 1,000 executives compiled for Bloomberg News by NTC Economics Ltd., is at the lowest level since its introduction in January 2004. Sales also fell from a year earlier.

.....

``Rising inflation is hitting households' purchasing power and is undoing some of the positive stimulus, such as strong employment growth and rising wages,'' said Nick Kounis, an economist at Fortis Bank in Amsterdam. ``The dilemma facing the ECB just gets worse.''

.....

Sales fell across all three of the largest economies in the euro zone, led by Italy, where retail spending dropped at the fastest rate in the survey's history. In Germany, sales fell the most in three months, while in France they declined the most since January 2006.

``Italian indicators have been on a predictable and steady downward trend for the past year,'' said Morgan Stanley economist Vladimir Pillonca, who predicts Italy may be the first and only country in the euro region to enter into a recession this year.

Praktiker AG, Germany's second-largest home-improvement retailer, said April 23 that its first-quarter loss widened on weaker demand. Chief Executive Officer Wolfgang Werner said ``the first three months were very bad in domestic sales.''

In France, ``inflation and the end of the rise in real-estate prices, and of the ability to take on loans, are weighing on consumption,'' said Yann Lepape, an economist at Oddo & Cie. in Paris. ``The trend is starting to go downward.''

The situation in France should look really familiar by now.

There was more bad news from the euro area:

The initial selloff in the common currency came during the London trading session, after news that French consumer confidence fell to a record low in April and a euro-zone retailing index plunged. This reinforced attitudes that the economies of Europe are succumbing to the spill-over effects of the U.S. economic downturn.

Regarding Japan, Terri Belkas at DailyFx summed up Japan's basic problems on Saturday:

Inflation driven by rising costs will discourage spending by firms and consumers alike and leaves the Bank of Japan in a precarious position. While the policy board likely remains in favor of rate normalization, substantial downside risks to exports and faltering consumption will force the Bank to leave rates unchanged and if anything, will lead them to consider cutting rates. Nevertheless, with interest rates already at an ultra-low 0.50 percent, the stimulating potential of a 25bp rate cut would be extremely small and leaves the odds in favor of steady rates for much of this year.

On Wednesday, the Bank of Japan released its half-year report, which concluded

"Japan's economy is slowing, mainly due to the effects of high energy and materials prices," the BoJ said it its half-yearly outlook report Wednesday. "Given the current situation where the outlook for economic activity and prices is highly uncertain, it is not appropriate to predetermine the direction of future monetary policy."

The bank said conditions had weakened since its October outlook, with both housing and business fixed investment weaker than expected.

The world's second-largest economy will grow at 1.5% in the fiscal year ending March 31, slower than an October forecast for a 2.1% expansion, while consumer prices will rise 1.1%, faster than an earlier estimate for a 0.4% rise, the central bank said in a statement. Growth next year is likely to range between 1.5% to 2%, boosted by a rebound in overseas demand and easing commodity prices, the bank said.

Japan held interest rates at .5%. In addition, the report omitted a reference to raising interest rates for the first time in two years."

Also note the euro/dollar sentiment is changing:

"Europe is really not insulated and its economy is beginning to show signs of a slowdown," said Meadows. "While most people now believe the Fed is about to end its easing cycle, a growing number of investors believe the ECB may have to start cutting rates really soon."

Barron's ran a story last weekend that argued the dollar will rally this year. Here is the basic reasoning:

When the Federal Reserve cuts interest rates for a seventh consecutive time this Wednesday, it will begin to wind down a pernicious campaign that has flooded the market with cheap dollars since last summer. At the same time, the whoosh of air from Europe's deflating credit bubble puts new pressure on the European Central Bank to begin cutting borrowing costs in order to goose growth.

The result should be a major shift in global monetary policy that reverses billions of recent short-dollar, long-commodity bets and undercuts high-flying stocks like fertilizer outfit Mosaic (ticker: MOS) and oil-services giant Halliburton (HAL) that earn gobs of money overseas. The strategy shifts by central banks will drive a greenback comeback against the overpriced euro, turning back the 15% slide that since August has lifted the euro -- to a record $1.60 last week -- even as the dollar continues to struggle against the undervalued currencies of emerging Asia.

After the Fed rate cut, the dollar dropped:

The dollar fell after the Federal Reserve reduced its target for overnight lending between banks by a quarter-percentage point to 2 percent, the lowest level in almost four years.

The U.S. currency dropped versus the euro, pound and real as policy makers said the economy remains weak, indicating to some traders the Fed may lower rates further if warranted. The dollar has decreased 12 percent against the euro since Sept. 18, when the Fed began lowering the target from 5.25 percent.

``The Fed kept all of their options open,'' said Michael Woolfolk, senior currency strategist at Bank of New York Mellon Corp. in New York, the world's largest custodian bank, with more than $20 trillion in assets under administration. ``The market expected more hawkish tones they didn't get, and the dollar rally is unlikely to materialize.''

The reason?

But there wasn't a decisive "all-clear" announcement on more possible rate cuts, which have been continuing for months and have been a big factor in the dollar's sharp declines. The committee noted "further" softness in U.S. labor markets and financial markets' "considerable stress."

"Our sense is that the market was looking for...a stronger signal of a policy pause," said Nick Bennenbroek, head of currency strategy at Wells Fargo Bank. "We suspect it is that lack of that direct signal that is contributing to the dollar's dip after the announcement."

As a result:

"We got a major status quo statement," Mr. Trevisani said. "We're now back to looking at economic statistics, and the market wants to sell the euro but they're not going to do it until there's proof, a change in U.S. economic data."

No comments:

Post a Comment