From Bloomberg:

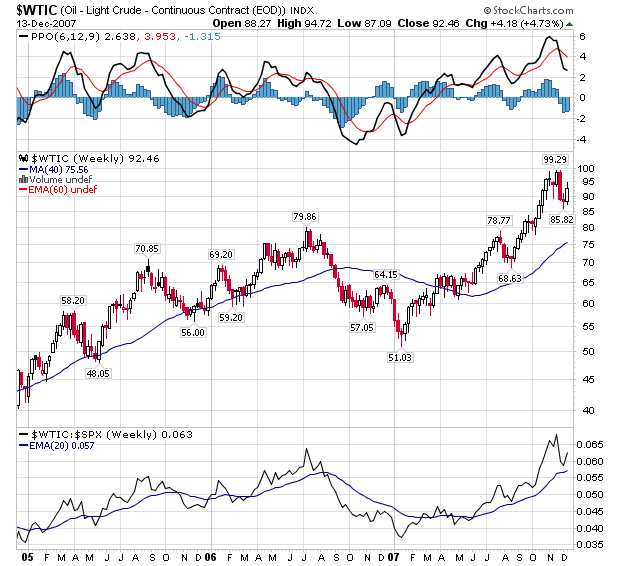

Prices paid to U.S. producers rose for a sixth month in June, pushed up by surging fuel costs that underscore risks of inflation.

The 1.8 percent increase was the biggest gain since November and followed a 1.4 percent jump the prior month, the Labor Department said today in Washington. So-called core producer prices that exclude fuel and food increased 0.2 percent, less than economists forecast.

Higher prices for fuel and raw materials cut into corporate profits and pressure them to raise prices. Federal Reserve policy makers, who have paused in their steepest rate cuts in two decades, last month said ``upside risks'' to inflation had increased and they would act ``as needed'' to foster both stable prices and growth.

``It was primarily confined to the energy sector,'' said Lindsey Piegza, an analyst at FTN Financial in New York, which correctly forecast the rise in the core rate. ``There is risk that in the future they could seep through and cause an inflationary spiral, but right now inflation is going to take a back seat to the slowing economy'' on the list of Fed concerns.

See -- if only we the news reports dealt exclusively with core inflation then everything would be OK.

Also note the following:

The Labor Department said producer prices over the last 12 months were up 9.2 percent, the biggest increase since a 10.4 percent gain in June 1981 when the United States was last mired in a low-growth, high-inflation period known as stagflation.

Isn't that just wonderful?