The good news from the report is the year over year number popped up. However, considering the overall trend for the last 9 months has been negative we'll need at least another month (or two) of data before we can say whether or not the trend has changed.

On he expenditure side, it looks as though the trend is down since the end of the summer with a bump up last month and a move lower this month. Considering the high price of gas and a slowing job market, that makes a bit more sense.

From Bloomberg:

``Consumers are spending cautiously,'' said Michael Moran, chief economist at Daiwa Securities America Inc. in New York, who correctly forecast the gain in spending. ``The economy is in a grey area between recession and slow growth.''

Regarding incomes, not the following points from the AP:

The Commerce Department reported Friday that consumer spending barely budged in April, rising a tiny 0.2 percent, and income growth was just as weak, increasing a similar 0.2 percent.

The growth in incomes, restrained by four straight months of job losses, would have been just 0.1 percent had it not been for the first wave of economic stimulus payments the government started sending out April 28.

The AP also noted the low position of consumer sentiment, which is probably restraining growth:

The Reuters/University of Michigan survey of consumer sentiment dropped for a fourth straight month in May, hitting a 28-year low of 59.8, down from a reading of 62.6 in April. The May level was the lowest since June 1980, when Jimmy Carter was in the White House and consumers were being battered by a recession and soaring gasoline prices.

I've posted these charts a few times, but it bears repeating: consumers are not happy:

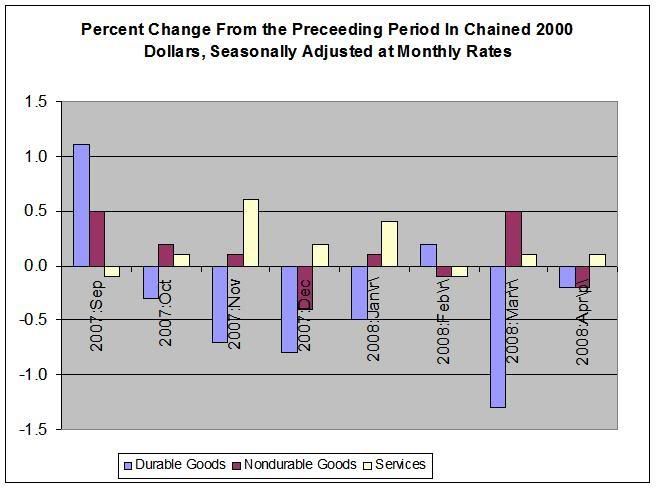

Here's an interesting chart, culled from the actual data.

Notice this is chained (inflation adjusted) numbers. Note that durable Goods orders have been down for the 6 of the last 8 months. Assuming that people buy more durable goods when they are confident about the future, this is not a good sign.

The bottom line is this news is not good considering 2/3 of the economy comes from consumer's spending.

No comments:

Post a Comment